Capital Gains Tax: A Complete Guide On Saving Money For 2023

Profits are good but the capital gains tax isn’t. Here’s how to legally avoid and lower this tax. Check out our free tax consultation.

As much as we like capital gains, we don’t enjoy the tax on them. Investing in the stock market is an excellent way to save for retirement and build wealth over time, however, the steep tax rates can cut into your profit margins.

In this article, we’ll cover

- Capital gains definition and how is it taxed?

- How to avoid capital gains tax

- Short term vs long-term capital gains tax rates

Interested in cryptocurrency taxes? Here’s our in-depth article about this subject.

What Are Capital Gains?

Capital gains are realized profits on the sale of an asset. Common capital gains come through stocks, real estate, and bonds.

For instance, if you bought a house for $300,000 and sold it for $450,000, your capital gains would be $150,000. The difference between the purchase price and the selling price.

How To Avoid Capital Gain Tax? When Are They Taxed?

Capital gains tax is exactly what it sounds like — a tax on the profits of an asset. In the previous example, the $150,000 is subject to this tax.

But you don’t pay taxes on this tax as soon as you sell. Instead, you will fill out a form on your tax return.

The main way to skirt the capital gains tax is to hold assets for at least one year, if applicable to the type of asset. Though this doesn’t completely eliminate the capital gains tax, it can significantly reduce it.

Other ways to legally avoid capital gains taxes is to move to a state with lower taxes and reinvest profits (defer taxes) for real estate.

Short Term Vs. Long-Term Capital Gains?

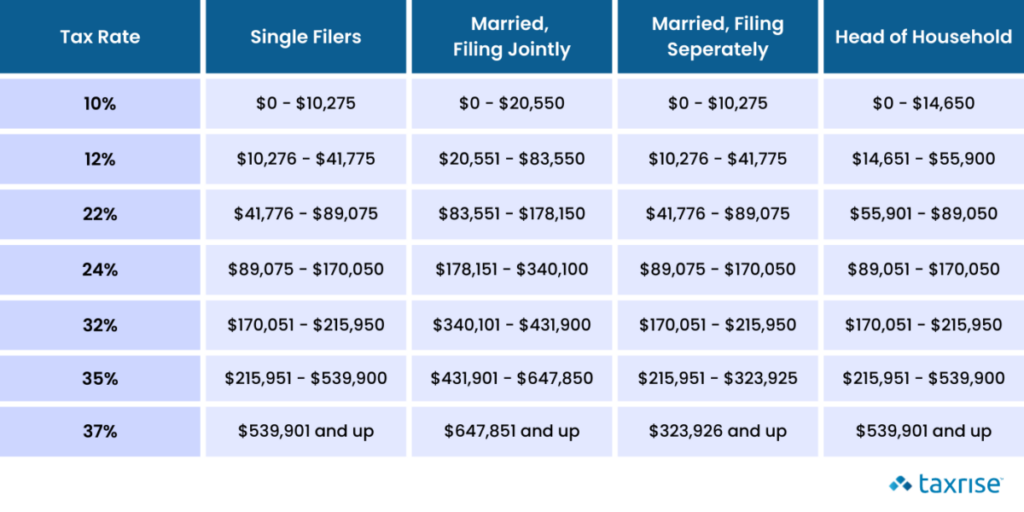

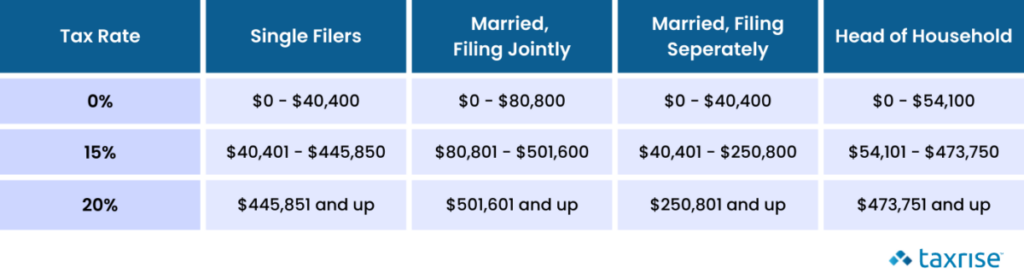

For some assets, such as stocks, the length for which you hold the asset affects the tax rate. In these cases, short-term capital gains (less than one year) and long-term capital gains (held longer than one year) come into play.

Let’s look at both tables below.

Short-term capital gain

Long-term capital gain

What Happens If I Don’t Report My Capital Gains?

Not reporting your capital gains will get you in trouble. Though negligence has a low chance of jail time, if the IRS can prove you purpose.

The Takeaway

If you’re under pressure from the IRS, check out TaxRise’s free tax consultation. From this 30-minute call, you’ll be able to determine if you qualify for our services and which tax relief program will work best for your unique situation.

We represent taxpayers who are in hot water with the IRS. We ensure the best relief outcome possible while saving you time, stress, and money.

TaxRise has helped thousands of taxpayers just like you resolve their tax issues and erase their tax liability. Book your call and get started today!