Gordon and Chrissy's Case Study

Mechanic and His Family Resolve $18,000 in tax debt

TaxRise settles tax debt for 97.3%

| March 11, 2021

Farmington, New Mexico – Mechanic and his family had years of federal and state tax debt, but with the help of TaxRise, they settled their liability for good.

Tax debt is like an avalanche. Because the IRS uses daily compounded interest, all it takes is one year of unfiled or unpaid taxes for a minor issue to grow into a big problem.

In the case of Gordon and Chrissy Captains*, one year of unpaid state and federal taxes led to another year – which led to another and another until eventually, they had $18,642.01 in tax debt.

The IRS constantly adds interest and penalties to tax debt - making it grow bigger and bigger each day.

Stuck in a $367 a month IRS payment plan, the Captain’s family needed an alternative.

TaxRise's Resolution Strategy

When TaxRise took Gordon and his family in as clients, we realized that the IRS had sent a private debt collections company after them.

Freeing the Captains of both the third-party collectors and the IRS installment agreement would require an offer in compromise (OIC).

TaxRise knew an OIC was the best solution to their tax issue.

An OIC is an agreement between the delinquent taxpayer and the IRS to settle the total tax debt for a more manageable amount.

It is difficult to qualify for an OIC – the IRS requires a lot of financial documentation. However, TaxRise expertly guided Gordon through the resolution process.

The End Result

In the end, the IRS reduced Gordon and Chrissy’s tax debt of $18,642.01 to $500! The final result was a settlement of 2.7% – saving over 97.3%.

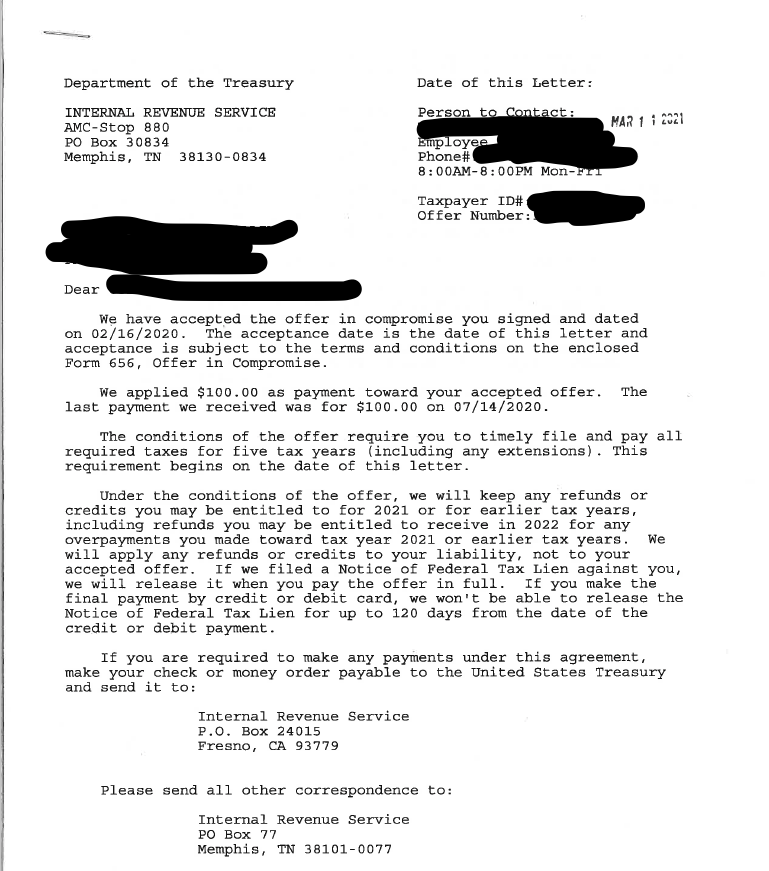

See Gordon and Chrissy’s signed Offer in Compromise Below!

* Client’s name changed for privacy.

Take our brief survey to see if you qualify for the Fresh Start Program.