💡 Key Takeaways

-

The IRS contacts taxpayers by certified mail — not email, text, or social media.

-

Genuine IRS notices include logos, notice numbers, and verified contact info.

-

Red flags: urgent payment demands, threats, or requests for sensitive data.

-

Verify notices on IRS.gov and use trusted IRS resources like the “Dirty Dozen” list.

With modern technology, it’s easy for anyone to impersonate the IRS. This includes tax debt notices, emails, text messages, and more. It’s essential to exercise caution when receiving unsolicited communication resembling the IRS and to stay aware of tax scam tactics.

Understanding Common Tax Scams

Common signs of IRS impersonation include demands for immediate payment, threats of arrest or legal action, and requests for personal information such as Social Security numbers. These scams typically begin with an unsolicited interaction claiming to be from the IRS, which pressures individuals into taking immediate action.

The IRS will never initiate contact by phone, email, text message, or social media to request personal information or payment. Official communication from the IRS is initially sent via certified mail, delivered by the U.S. Postal Service. Only then may the IRS request your permission to contact you through other methods. Taxpayers also have the opportunity to question or appeal any claims before action is taken.

How to Identify Official IRS Communication

The IRS consistently mails official notices throughout the year to taxpayers who owe. Bad actors may take advantage of this, capitalizing on heightened concerns to persuade individuals to send sensitive personal information. It is highly advised that taxpayers exercise caution when receiving unsolicited communication claiming to be from the IRS.

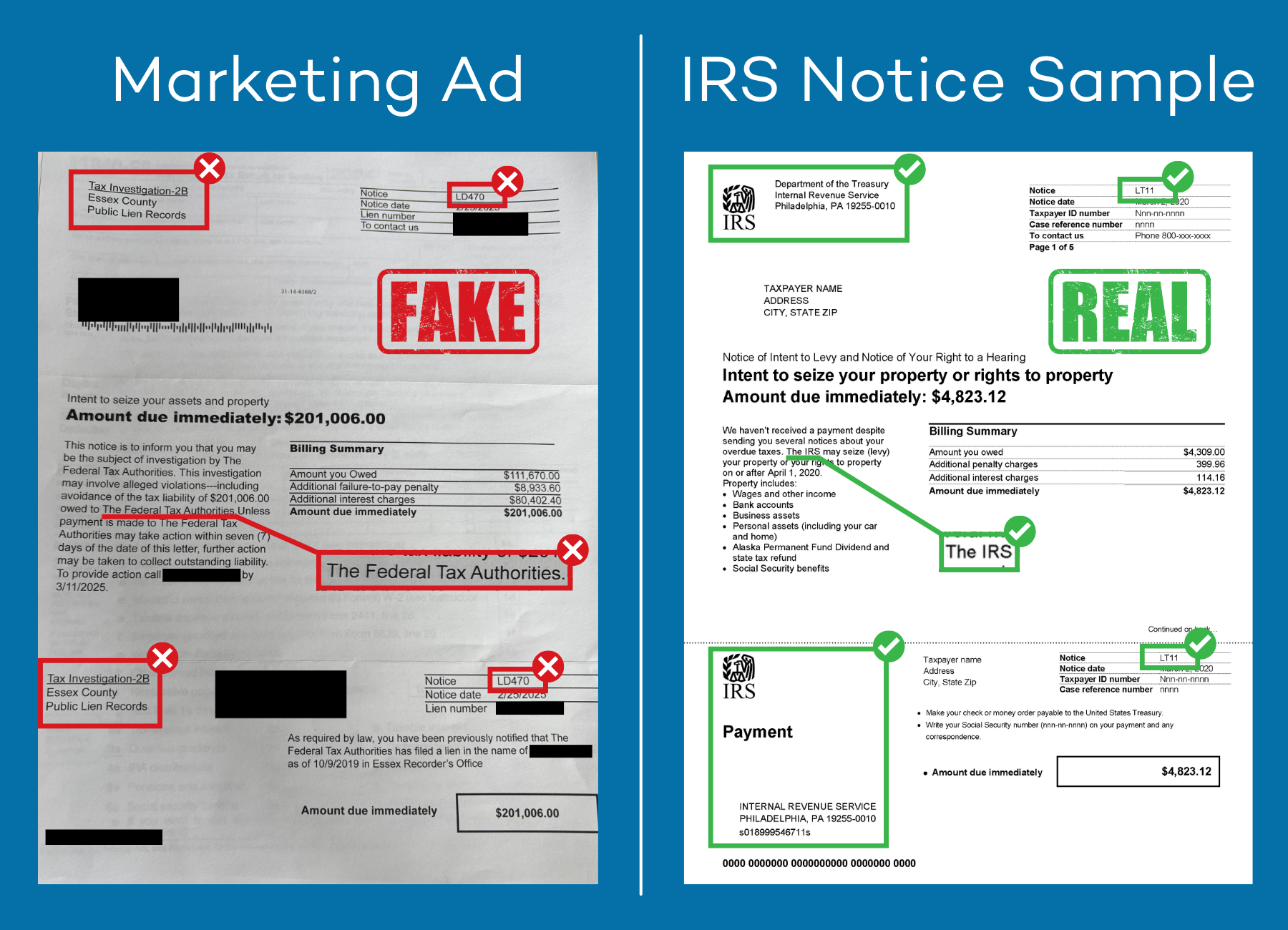

All official IRS correspondence has clear identifying information, including, but not limited to, an IRS logo, notice number, and instructions to contact the agency directly through verified channels. A false notice will rely on vague, but official-sounding language in an attempt to persuade the taxpayer. It will also lack any visible identification or company logo.

Anyone who receives a suspicious notice is encouraged to avoid responding directly to the sender. Instead, taxpayers should:

- Thoroughly review the letter and identify the sender, if possible.

- Take note of any notice number and verify it on IRS.gov.

- Check the legitimacy of the notice by contacting the IRS at a phone number listed on IRS.gov.

- Seek assistance from a reputable tax professional.

Stay Ahead With Taxpayer Resources

As part of its ongoing commitment to taxpayer advocacy, TaxRise provides resources and services to help individuals navigate complex tax issues and protect themselves against tax-related fraud. Whether it’s learning about common IRS notices or how to protect yourself from IRS scams, our experts are dedicated to helping all clients.

We also recommend reviewing the annual IRS ‘Dirty Dozen’ guide of updated tax scams. This list outlines various fraud schemes scammers deploy to steal taxpayer information and money.

Our team aims to empower taxpayers to avoid falling victim to typical IRS impersonation schemes and recognize the proper channels of IRS communication. For any questions related to IRS notices or tax resolution, feel free to call 833-419-RISE (7473) and schedule a free, no-obligation consultation today.

Frequently Asked Questions

Yes, tax impersonation scams are still ongoing in 2025. Many tax firms report a surge in cases, especially during tax season when taxpayers are busy preparing their tax returns or are expecting something in the mail.

No, the IRS does not initiate first contact via text message, social media, or messaging apps like WhatsApp. Any text claiming to be from the IRS, especially those with suspicious links or payment requests, is most likely a scam.

If you suspect a tax impersonation attempt, do not respond or click any links. Immediately report phishing to the IRS and the Federal Trade Commission (FTC).

It is highly recommended to cross-check the contact details on the official IRS or state tax websites. You can also log in directly to your online tax account instead of clicking any email or SMS links. When in doubt, always call the IRS through official published numbers or reach out to a tax professional.

No. The IRS sends multiple written notices before taking any legal action and never demands immediate payment under the threat of arrest or deportation. If you receive any threatening notices or messages, do not respond and contact the IRS directly to report it.

0 Comments