Despite paying on an installment plan religiously for years, the IRS threatened to seize Karen’s retirement funds to pay $50,000 in tax debt. But at age 66, newly unemployed, and Social Security as her only income, she could ill afford to tap into money saved for the future. TaxRise successfully negotiated with the IRS to lower her unaffordable $687 payment to a manageable $100 per month. Best of all, Karen no longer lives in fear of the IRS taking her hard-earning savings.

Here’s Karen’s story:

Take My Word For It: Don’t Fight the IRS Alone

This phone number — 800-829-1040 — still gives me nightmares.

It happens to be the portal to IRS hell, as I like to call it, and its so-called customer service department. I had the number on speed dial for six months, right along with my therapist.

My tax debt piled up over the years from a combination of pretty common reasons: At one point I had too little tax withheld from my paychecks; I suffered one of the dreaded “unexpected life events” — divorce; and I couldn’t afford to pay taxes from 1099 income.

Now, I understand that your Do-It-Yourself (DIY) experience with the IRS to settle tax debt may have been a success. It’s probably because you owed less than $50,000, the amount set by the IRS to qualify for a more streamlined process.

A rep likely set up an installment plan for you based on a simple equation: Divide the total tax debt, including interest and penalties, by 72 months (the length of time the IRS gives you to pay the balance). For example, with a $12,000 balance, the baseline monthly payment would be $12,000 ÷ 72 or $166.67.

I did the same, but it didn’t “fix” my problem. I’ll explain in just a bit.

On the other hand, if you know those 10 digits as intimately as I do, I’m really sorry. I’m even sorrier if the number stirs up bad memories from a past IRS experience.

I, and a whole lot of other people, can relate. Here’s proof.

While the IRS doesn’t distinguish between taxpayers trying to settle debt on their own versus using professionals, the stats for the number of Offers in Compromise (OIC) accepted by the IRS in FY 2024 stunk.

A total of 33,591 OIC were submitted to the IRS. Of these, the IRS reported that it approved 7,199, resulting in an acceptance rate of about 21.4% for all applicants — meaning 26,392 offers were rejected.

That’s why I hope my story changes your mind if you’re considering settling a tax issue without professional help. Sparing you from the same IRS-induced grief is one of my top priorities.

When Life Hands You Lemons

Before I continue, here’s a little about myself: My name is Karen. I’m a divorced, 66-year-old professional woman with a background in journalism, specifically writing about finance and technology. I’m college educated, confident and very accustomed to handling life’s challenges on my own.

For most of my six-plus decades, I believed that if I just worked hard enough — and always treated people kindly — I could wade my way through anything. And I did for the most part. However, I never imagined that at my current age that I’d be battling the IRS over a smothering mountain of debt.

Like many women, divorce complicated life and ushered in challenges I’d never anticipated.

As though being forced to sell my home wasn’t punishment itself, I also lost the mortgage and property tax deductions that helped reduce taxes for so many years. Plus, filing as a single person meant less take-home pay and more to Uncle Sam.

I made due with what I had, raising my teenage son and doing my best to keep his lifestyle in tact and schools the same, despite the incredibly high cost of living here in Orange County, Calif. To cover our basic expenses, I supplemented my income with 1099 freelance work, but I fell behind estimated quarterly payments.

Like I said, I tried to be responsible — I set up that installment plan online and paid the monthly amount religiously. But interest and penalties mounted. Year-after-year I watched my balance grow instead of shrink.

What started as something manageable eventually snowballed into $50,000+. My monthly payments, once around $300, steadily climbed to nearly $700.

Then, more walls came tumbling down after the pandemic. In a matter of five years, I lost three jobs through no fault of my own. My once-stable position as editor of an IT magazine for 20 years was eliminated. Then, a couple of years later, I Iost my content manager role with a financial publisher.

And, most recently, I experience my hardest job loss ever as a senior investment writer for the same reason as the others.

I sank lower and lower emotionally and financially.

The Most Exhausting Six Months Ever

After a lifetime of working — and I never stopped, not once — I felt like I had nothing left to show for it. Besides losing my most prized possession, my home, I drained nearly $200,000 from my 401(k) to cover bills after my ex lost his job. Savings I spent decades building disappeared.

Thankfully, I’d managed to build a small nestegg over the past few years … big enough to boost my confidence about taking a much-needed break from the rat race.

Staring at unemployment checks as my only source of income and many more expenses outside of a tax bill to pay, I began taking Social Security. Instead of seeking another full-time job, I would retire (at least for now).

My next move? Contact the IRS to share my “unexpected event” and try to resolve my debt by either filing for a “Currently Not Collectible” (CNC) status, or at the very least reduce the amount I had to pay monthly. A CNC temporarily pauses the IRS collection if you can’t afford to pay without causing financial hardship. And you must be able to prove an inability to pay after covering necessary living expenses.

If a taxpayer’s debt exceeds $50,000, like mine did, the IRS requires detailed financial disclosure then calculates the payment based on disposable income with another equation: Monthly Income – IRS Allowable Expenses = Monthly Payment.

According to my math and my numbers, qualifying for a CNC designation was a no-brainer. So, I went into the battle highly confident that I would succeed and find compassion and sympathy along the way. Keep in mind, I’d never missed a payment or ignored a notice — two no-nos that I knew would come back to haunt me.

Was I ever wrong.

I Felt Bullied … and Some

I encountered hostility, bullying, poor communication, a lack of compassion, and an unwillingess to compromise.

I told the first agent that “helped me” that I could no longer afford to pay $687 per month due to job loss and about my subsequent choice to retire and take Social Security. She explained that if I couldn’t pay $687, I should send whatever I could. So, I paid $100 for the next few months.

The agent said she would send the application to her manager for approval, and I’d hear from the IRS within 10 working days. I heard the same spiel from three other agents and two outside tax advocates over the next few months — and I never heard back from anyone.

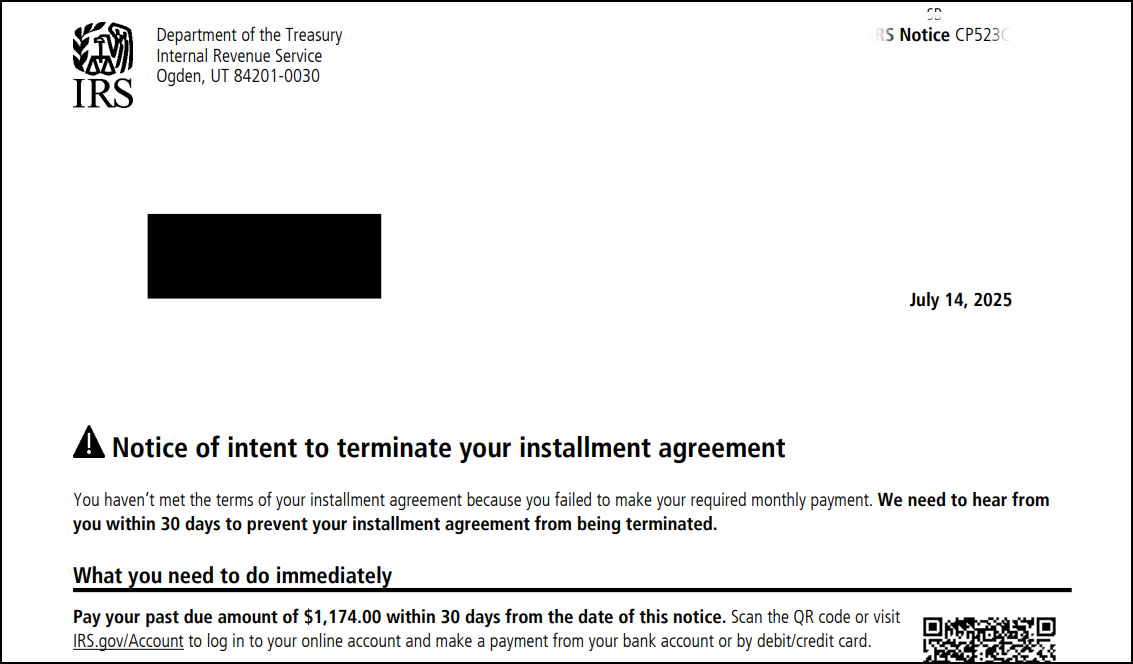

Instead, I received six certified letters, each represented the individual years in which I owed back taxes. They all displayed the same message: Notice of intent to terminate your installment agreement.

That same day, I spent two hours on hold just to reach an agent; and after she finished collecting all my information, the call dropped.

Rather than not doing the same thing and not expecting different results — the definition of insanity — I called back and reached another IRS rep. Not only did I have to repeat my entire story, he made me jump through hoops.

He dug deeper into my financials than the other agents I’d spoken to, and when I disclosed the balance of my Rollover IRA — large enough to pay off my debt — his manager quickly rejected my CNC request.

I then asked if I couldn’t get a CNC status if the IRS would reduce my $686 monthly payment to $100, and I even got pushback from that request.

To prove that my unemployment benefits were going to end in one month, he told me I needed to fax him the award letter the California Education Development Department (EDD) sent me five months prior.

He literally gave me five minutes to find and fax it to him. If I didn’t, he threatened that the IRS would cancel my installment agreement and pursue liens on any property and money, including bank accounts and retirement.

I complained that I’d spent hours on the phone with the IRS and deserved a little grace, but he didn’t seem to care.

After a very quick five-minute search of my files, I couldn’t find it and gave up. In a brief moment of humanity, he decided to give me another opportunity to fax it to him within 10 days, stressing again what the consequences would be if I didn’t.

I lost it after that phone call.

For six exhausting months, I felt a rollercoaster of emotions: stress, hopelessness, fear, embarrassment, bullied, out of control, angry and defeated from the whole ordeal.

But don’t take my word for it. Other taxpayers described their failed efforts:

- “Overwhelming and confusing” due to complicated IRS notices, forms, and requirements.

- “Like negotiating with a wall”— a feeling of futility and lack of response.

- “Like being stuck in an endless paperwork shuffle.”

- Felt like being “pulled into a legal case with rules stacked against you.”

- “Worse than dealing with other creditors or bankruptcy,” because of strict rules and the IRS’s relentless collection mechanisms.

The final complaint is particularly cringeworthy. That’s because unlike banks, credit card issuers, and other debtors, the IRS operates as the “creditor” with the authority for setting terms and executing judgment.

In more recognizable words, the IRS is “the judge, jury, and executioner” — roles the legal system forbids individuals to hold simultaneously. Apparently, there’s a different set of rules for the IRS.

So, no, I did not accept the gracious, 10-day extension offered by the last IRS agent I spoke to.

Instead, I smartened up and called 833-419-7473.

Oh What a Relief It’s Been!

That just so happens to be the phone number for TaxRise, a tax relief company based here in Orange County for people struggling with tax debt.

Why I waited so long to reach out still boggles my mind.

My TaxRise rep assured me that the team would do everything it could to help. They listened; they sympathized. Then, they took my matters into their own hands.

The team gathered my documentation, confirming that I was no longer employed along with a bank statement to support my current financial situation. They contacted the IRS on my behalf and showed that at my age, with no steady income, I simply couldn’t afford what the agency demanded.

A couple of weeks later, they called me with the good news: The IRS approved a new, lower payment of $100. Best of all, my assets were no longer under seize.

Just like that, the unbearable weight on my shoulders lifted. For the first time in nearly a decade, I felt like I could finally breathe.

My life is no longer defined by fear every time I open the mailbox or check my bank account. More than anything, I wish I had known I didn’t have to face this alone instead of wasting six months I’ll never get back.

After a lifetime of challenges faced on my own, I finally realized that asking for help wasn’t weakness — it was the best way forward.

So, today, I have just one phone number on speed dial: 833-419-7473.

Thanks TaxRise!

The views and opinions expressed in this testimonial are solely those of the author based on their personal experience with the company’s services and are not a guarantee of similar results for others.