Ohio – Ada could barely afford necessary living expenses after the death of her husband, but with TaxRise, her $3,300 tax debt was settled for $500.

Ada Samson* began working as a cook out of necessity due to the passing of her husband. When she still had her husband, there was no need for her to work since he was the primary wage earner for their household.

For some time, Ada managed her expenses by using her late husband’s pension and the money from her Social Security.

However, she quickly realized that this would not last forever. The money from his pension was set to end and, to make things worse, she received a letter from the IRS.

With the passing of her husband, Ada needed to find work and resolve her back taxes.

In 2010, Ada and her husband had not filed their taxes, and in 2009, they had not paid their taxes. As a result, the IRS informed Ada that they were going to garnish her Social Security.

When Ada approached TaxRise with her dilemma, she was barely making enough to afford her living expenses – even with her new job.

TaxRise’s Resolution Strategy

Immediately, TaxRise’s experts went into action to halt or delay the garnishment on Ada’s Social Security. So, we entered Ada into an installment agreement with the IRS and filed all of her unfiled taxes.

Becoming current on your taxes and making efforts to repay your tax debt via payment plans is a great way to show the IRS that you are taking legitimate action to rectify your tax debt.

Ada didn’t have much money to spare, so we negotiated with the IRS, and they placed her in a $100 per month plan. The temporary installment agreement stopped the garnishment – now it was onto her $3,300 tax debt.

Ada’s actual tax debt was much larger, but TaxRise was able to reduce her total through skillful negotiation.

While Ada’s actual tax debt was somewhere around $9,000, TaxRise managed to decrease this total after correcting her misfiled and unpaid taxes. Nevertheless, she still had $3,300 that needed resolving.

Our tax professionals complied plenty of documentation from Ada, including pay stubs, bank statements, and a handwritten, special circumstances explanation. Once TaxRise had all the essential evidence, we negotiated with the IRS on Ada’s behalf.

The End Result

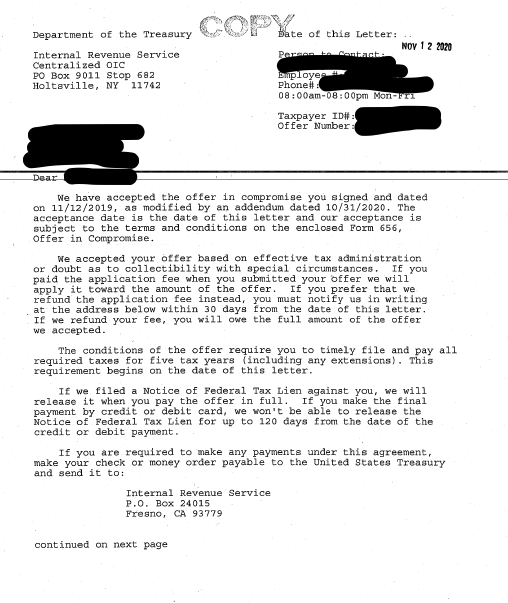

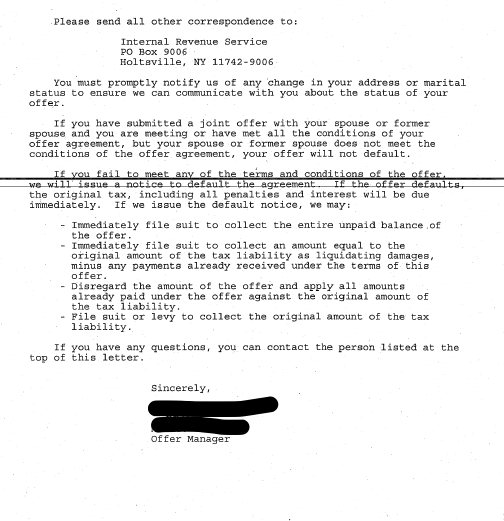

After much discussion, the IRS accepted Ada’s offer in compromise and settled her $3,300 tax debt for $500! Thus, we settled Ada’s tax debt for 15% – a saving of over 85%!

See Ada’s signed Offer in Compromise Below!

Be the next success story. Take our survey to see if you qualify for the Fresh Start program.

* Client’s name changed for privacy.