TaxRise settles debt for 97.1%

Eagle River, Alaska – Thanks to TaxRise, this military family recovered from two garnishments and permanent job loss related to COVID-19.

With Al’s 22 years of active duty as a military contractor combined with the unpredictability of America’s last frontier, Al* and Malley* are no strangers to adversity.

Nevertheless, when Al permanently lost his contracting job because of COVID-19, they knew they were in a serious pinch.

Al lost his military contractor job due to COVID-19.

To make matters worse, they had $106,321 in tax debt plus two garnishments to their Alaska Permanent Fund income and Department of Defense income.

TaxRise’s Resolution Strategy

From the start, TaxRise prioritized the removal of the two garnishments. However, releasing a garnishment is no easy task – but we were up to the challenge.

Our tax experts placed Al and Malley into an installment agreement with the IRS for $1,652 a month. While this strategy may seem counterproductive, it’s actually the best way to remove garnishments.

TaxRise entered our clients into an installment agreement to remove the garnishments.

The IRS sees that our client is making an effort to repay their debts and halts all other collections and penalties to ease the repayment process.

However, TaxRise wasn’t going to leave Al and Malley with a $1,652 monthly payment. Soon after the installment agreement began, we sent an offer in compromise request to the IRS for a reduction.

The End Result

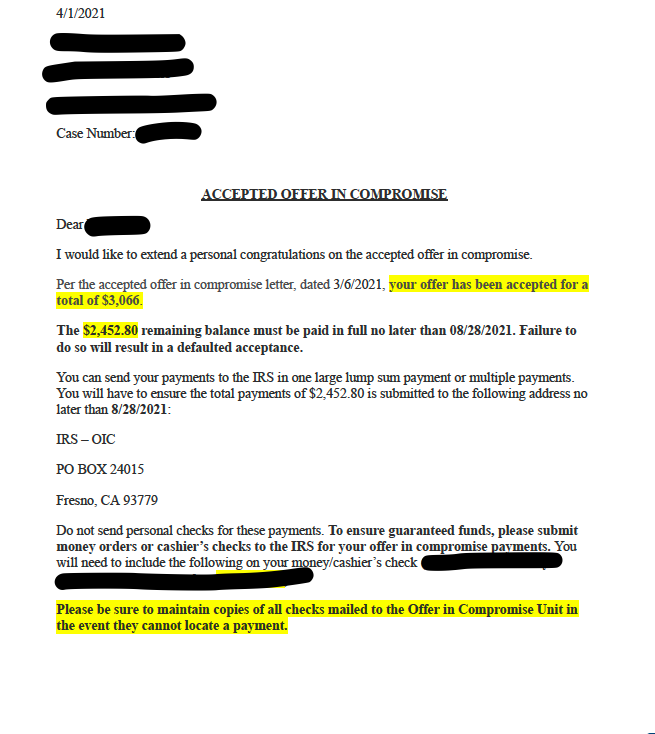

The IRS accepted Al and Malley’s offer in compromise to resolve their $106,321 tax debt for $3,066. The total debt settled for 2.9% – a saving of over 97.1%.

See Al and Malley’s signed Offer in Compromise Below!

* Client’s name changed for privacy.

Take our brief survey to see if you qualify for the Fresh Start Program.