TaxRise Reduces a Business Owner’s Tax Liability by 95%

Saint Cloud, FL | March 2020 – In an extraordinary demonstration of perseverance, a United States veteran battling chronic illness overcomes a complex tax situation and mounting financial pressures, ultimately finding relief through TaxRise’s services.

Alexandro Perez* faced what seemed like insurmountable odds: ongoing medical treatments, shared mortgage responsibilities, and an overwhelming IRS debt. Through TaxRise’s dedicated efforts, his $87,143.60 tax burden was reduced to just $4,332.

What began as unintentional filing errors between 2013-2016 would spiral into a complex tax situation that, combined with chronic health challenges, would push Alexandro to the brink of losing his property and vehicles.

A Cascade of Challenges

Alexandro’s troubles started mounting in 2013 when his chronic illness began requiring constant treatment.

As a self-employed individual, Alexandro faced the intricate and often confusing world of tax filing. What should have been routine tax submissions became a series of unintentional filing errors, a common pitfall for self-employed individuals dealing with more complex tax requirements than traditional employees.

By the time Alexandro reached out to TaxRise, his situation had become critical. The IRS was threatening to levy and seize both his vehicles and property – essential assets for his work and living situation. The pressure was mounting, and time was running out.

TaxRise’s Resolution Strategy

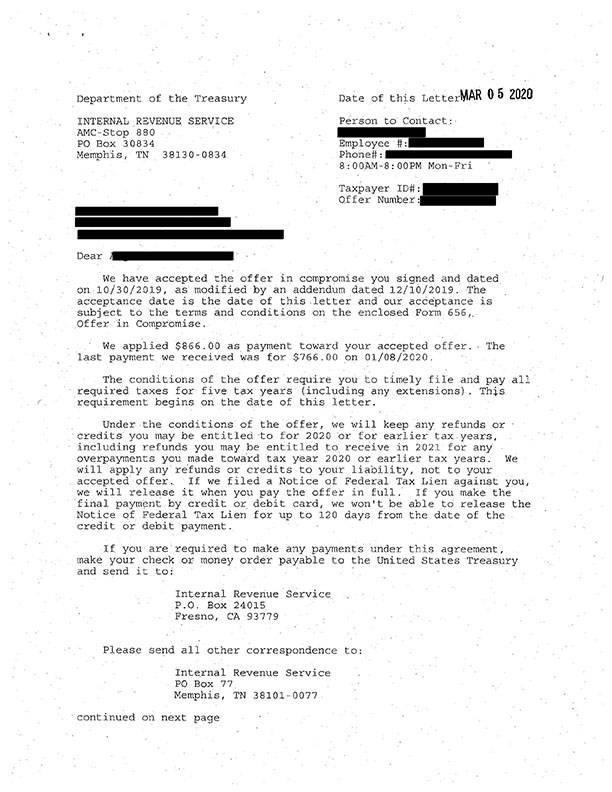

Our team immediately investigated Alexandro’s tax history, quickly identifying him as a strong candidate for the Offer in Compromise program (OIC). Working directly with the assigned Revenue Officer, we began building a compelling case.

The path wasn’t smooth for Alexandro. When his air conditioning system failed, requiring an unexpected $4,000 repair, our team immediately secured an extension from the IRS. Understanding the gravity of Alexandro’s health challenges and financial situation, we submitted his OIC application, demonstrating his genuine inability to pay his full tax liability.

The End Result

In a significant victory, the IRS accepted our offer in compromise, reducing Alexandro’s federal tax debt from $87,143.60 to just $4,332 – a remarkable 95% reduction. With this substantial burden lifted from his shoulders, Alexandro can finally focus on what matters most – his health and continued work serving his community.

See Alexandro’s accepted Offer in Compromise Below!

Be the next success story! Take our survey to see if you qualify for the Fresh Start program.

*Client’s name changed for privacy.