Montgomery, Alabama – Despite the musician’s unemployment and the lien on his property, TaxRise skillfully negotiates for his financial freedom.

Arthur Konrad* lives in Montgomery Alabama with his family and works as a musician at a church. Like most taxpayers in recent months, COVID-19 was a source of significant disruption, particularly concerning job loss.

Arthur was no different than most other Americans – the pandemic cost him his main source of income.

COVID-19 led to Arthur’s unemployment. Plus he had years of unfixed and unpaid taxes.

Arthur did have many years of unfiled and unpaid taxes, nevertheless, being released from his job was the tipping point. Arthur had amassed a considerable tax liability of $19,086.

With no means of income besides social security, Arthur and his family were facing difficult times. To make matters worse, the IRS sent a notification to him announcing that they had placed a lien on his property.

TaxRise’s Resolution Strategy

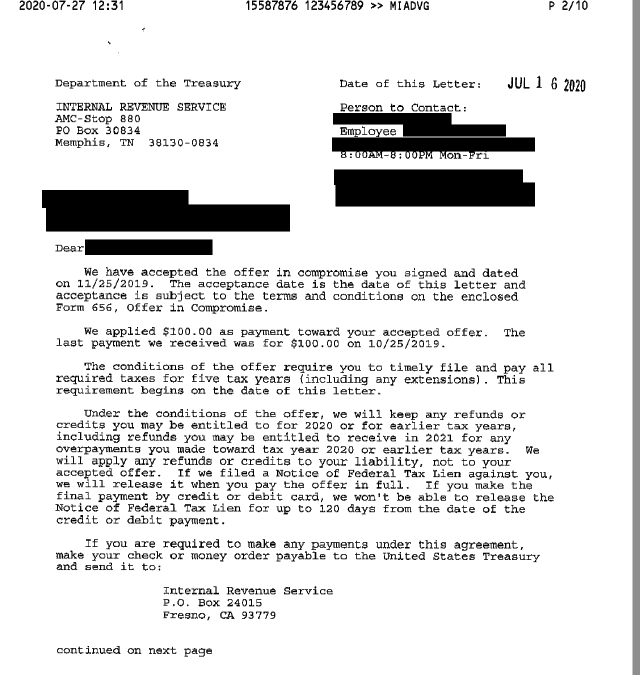

Upon receiving Arthur’s case, the tax professionals of TaxRise promptly made themselves busy by securing Arthur both power of attorney and, ultimately, an offer in compromise.

Predictably, COVID-19 provided many hiccups to our process. For starters, at the height of the pandemic, the IRS was incredibly backed up. Navigating the IRS was a nightmare as they were understaffed, backlogged, and occupied with stimulus checks.

However, this did not deter TaxRise. We were committed to securing Arthur with the best resolution possible.

The pandemic made it difficult to navigate the IRS, but we didn’t give up on Arthur.

The IRS was slow to respond which was making Arthur nervous. We maintained consistent contact with him, keeping him in the loop as much as possible.

At last, we got through to the IRS. They told us that they would approve Arthur’s offer in compromise if he could prove that he lost employment as a result of COVID-19. After collecting the necessary documents from Arthur, both parties reached an agreement.

TaxRise successfully settled Arthur’s original debt of $19,086 for $500. As a result, his IRS tax debt came out to a saving of over 97.4%.

The End Result

Arthur was released of the lien and his $19,086 debt was resolved for $500 – a saving of over 97.4%.

See Arthur’s signed Offer in Compromise Below!

Be the next success story. Take our survey to see if you qualify for the Fresh Start program.

*Client’s name changed for piracy