California – Domestic abuse survivor initially owed $420,936.90 to the IRS but, with the help of TaxRise, we reduced her tax debt to $500.

As is the case with many of our clients, Carly* was so preoccupied with her student loans, medical bills, and utilities, that she was never able to address her tax debt, which gained interest in the background.

In 2002, Carly was diagnosed with diabetes and heart disease. That same year she filed for divorce against a domestically abusive husband; she battled in the courts for four years until she ultimately lost custody of her two sons but maintained her daughter.

Even today, Carly pays for her children’s therapy and counseling expenses.

Carly’s life has been one of hardship – notwithstanding economically as well.

A few years later, in 2008, Carly had triple bypass surgery incurring a $135 medical bill each month. In 2013, she lost her job and decided to go to school to get a finance degree – which was not without a hefty student loan of $269 a month.

Fast-forwarding to the present, Carly is sitting at $420,936.90 in tax debt.

TaxRise’s Resolution Strategy

It was clear to the TaxRise team that Carly’s tax liability had grown out of control because of her many years of unpaid taxes. If we could get her current with her taxes, the IRS would look more favorably on an offer in compromise.

After rectifying all of Carly’s unpaid and unfiled taxes, her outstanding tax debt shrank to $2,873.32. When compared to almost half a million, this was a significant decrease. Nevertheless, we weren’t done yet.

TaxRise rectified all of Carly’s unfixed and unpaid taxes. But we didn’t stop there.

What was required next was to prove to the IRS that Carly could not repay $2,87.32 without suffering financial hardship. Our team collected from Carly previous medical bills, substantiation/ verification of her student loan, as well as proof of housing and utilities – any evidence of the monetary strain she endured each month.

Once we had acquired all the necessary information, our tax experts were ready to negotiate with the IRS examiner.

The End Result

At the beginning of our tax resolution process, Carly owed $420,936.90 in back taxes. We managed to cut that amount down to $2,873.32, and then with an offer in compromise, TaxRise settled Carly’s tax debt for $500 – saving over 99.9%!

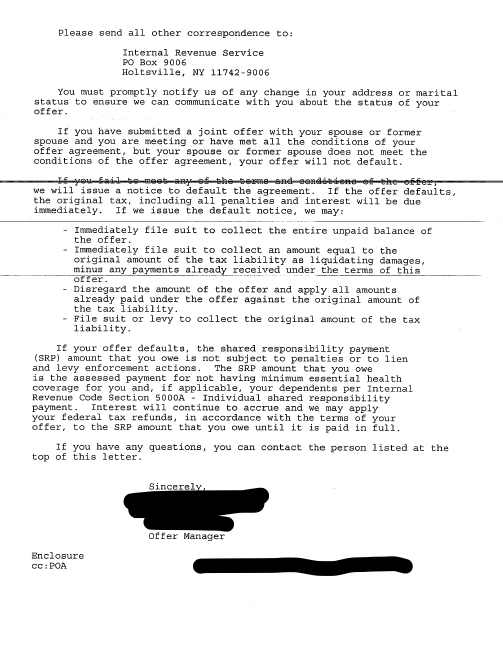

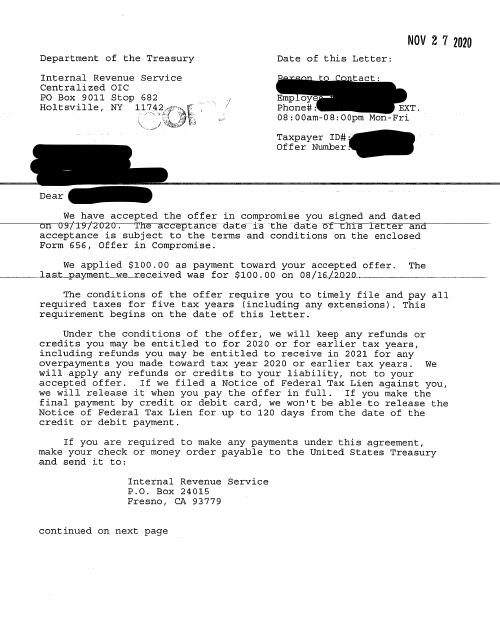

See Carly’s signed Offer in Compromise Below!

Be the next success story. Take our survey to see if you qualify for the Fresh Start program.

* Client’s name changed for privacy.