OAKLAND, CA. — Charles* always went to his local CPA to file his taxes each year and trusted that the job was done correctly. But when Charles got targeted for an IRS audit, it was revealed that his CPA had misfiled a number of elements of his tax return which revealed — much to his and his wife’s horror — the large tax bill.

At first, Charles tried to work with the IRS by himself. He emptied out his savings trying to repay the debt, but that barely made a dent.

By the time Charles came to TaxRise for help, his $126,185 tax debt had almost doubled to over $200,000.

TaxRise’s Resolution Strategy

So, we got to work. The strategy behind Charles’ reduction was a team effort. We first needed to stop the threat collections activities. With Charles and his wife’s combined income of just over $65,000 a year, we were able to make a financial hardship case for them since they were residing in the expensive Bay Area of Northern California.

We worked on placing Charles in a Currently-Non-Collectible status. This status stopped the collections and penalties, but we knew we had to work quickly since interest was still being accrued on his balance.

Then we began forming his settlement strategy. Since Charles and his wife didn’t have any liquid assets and were both nearing retirement, our tax attorneys negotiated with the IRS examiner for a settlement offer of only $650.

Thanks to the hard work of our tax professionals, we pulled off one of the largest saves in TaxRise history.

The End Result

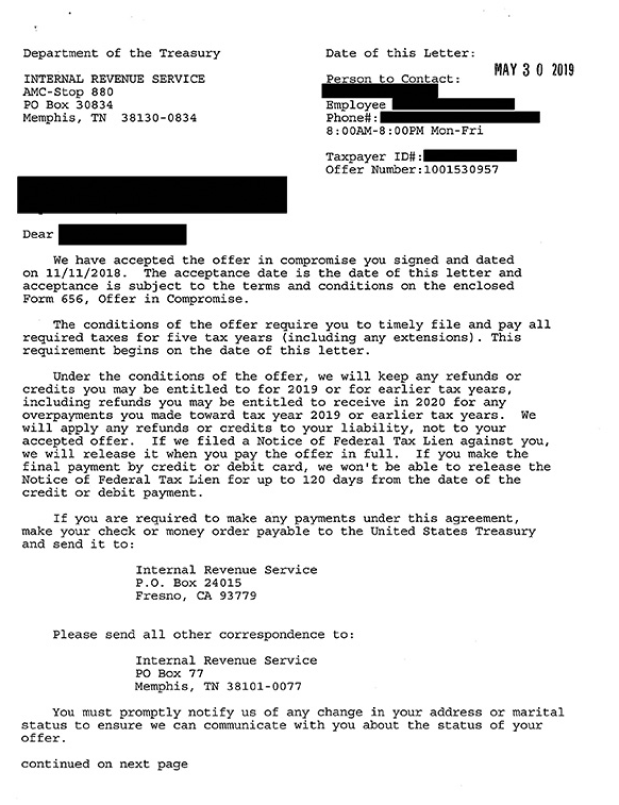

On May 30, 2019 we received the notice that Charles’ tax debt totaling $206,658 was settled for only $650 — a savings of over 99.99%.

See the accepted offer from the IRS below!

* Client’s name changed for privacy.