Indianapolis, Indiana – The TaxRise team successfully prevents the IRS from collecting unreasonably high payments from Chester, a night shift self-stocker.

Chester Dobbins* works for Kroger Co as a night stocker. He has lived in a men’s shelter since 2017. Due to a combination of medical and child support payments plus years of unfiled taxes, he had accrued a fair amount of debt.

In September of 2018, Chester entered into an installment agreement with the IRS. He diligently made payments of $93 a month (along with child support payments of $25 a week). Chester was keeping up with the payments, but the IRS decided that they needed their money before the end date of the installment agreement.

Due to medical and child support payments, Chester had accrued a fair amount of debt.

So, right before Christmas, Chester received a letter in the mail from the IRS. Contained within the letter was a demand for payment. They did not threaten a lien or wage garnishment against Chester, however, when a demand for payment is issued, such penalties are soon to follow.

TaxRise’s Resolution Strategy

Once TaxRise acquired Chester’s case, our goal was to remove him from his installment agreement and get him an offer in compromise. An offer in compromise (OIC) is the best debt resolution offered to taxpayers; it can wipe out debt by as much as 90% or higher.

To achieve an OIC, you must prove to the IRS that there is no way you could repay the amount they are demanding of you – usually by showing that you have experienced financial hardship or will experience a financial hardship as a result of repaying your debt.

Nevertheless, before we could proceed any further with the OIC, we needed to obtain power of attorney for Chester. The power of attorney blocks the IRS from collecting any more from the taxpayer while they are our client.

TaxRise got Chester off of his installment agreement and won him an offer in compromise.

After obtaining the power of attorney for Chester, our success or failure depended on the skill of our tax experts. TaxRise needed to convince the IRS of Chester’s inability to pay back his debt. The professionals at TaxRise built the best case possible for Chester then began negotiations with the IRS.

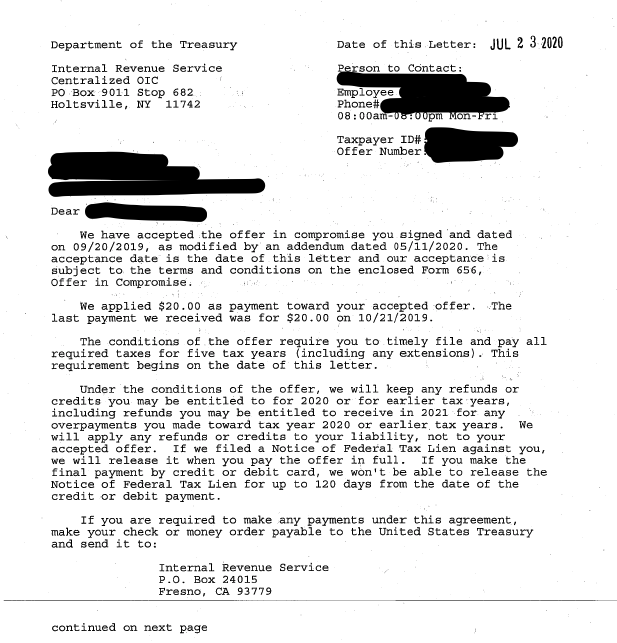

In the end, the IRS accepted our proposed OIC and resolved Chester’s debt. What was once a debt of $5,397, was reduced to $100 – a saving of over 94.3%!

The End Result

TaxRise was able to save Chester from paying back $5,397, and instead, he only needed to pay $100 to the IRS – a saving of over 94.3%!

See Sven’s signed Offer in Compromise Below!

Be the next success story. Take our survey to see if you qualify for the Fresh Start program.

* Client’s name changed for privacy.