Margaretville, New York – Darrell* took money out of his 403b, which resulted in penalties, garnished wages, and a levied bank account. Nevertheless, TaxRise prevailed.

Darrell currently works as a metal fabricator and installer. However, in the past, he helped run a nonprofit.

Tragedy would lead to the beginning of his financial hardships when his best friend passed away. Shortly afterward, the economy took a hit along with his nonprofit.

The IRS came after Darrell soon after he withdrew money from his 403b.

Darrell was losing so much money that he had to make an early withdrawal from his 403b, which resulted in penalties. At this point, Darrell owed taxes to the IRS. They decided to garnish his wages and levy his bank account.

Darrell and his family managed to survive the IRS’s onslaught – but owed $28,055.34 in back taxes. Although the garnishment and levy were over, the IRS placed a lien on Darrell’s assets.

TaxRise’s Resolution Strategy

Darrell’s situation was not so different than most of the cases TaxRise had resolved before. However, because of all the different types of jobs he and his wife had had, negotiating with the IRS would be tricky.

For example, after working for the nonprofit, Darrell worked as a 1099 gig worker and then a W-2 metal fabricator. Likewise, Noelle*, his wife, is a farmer and did not get paystubs, only direct deposits from her employer.

The TaxRise team worked hard to settle Darrell’s tax debt with the IRS.

The process of compiling all of the necessary information to present before the IRS examiner was quite a tedious task.

Nonetheless, the experts at TaxRise are talented and hardworking – they put in the needed hours to build the best resolution possible for Darrell and Noelle.

The End Result

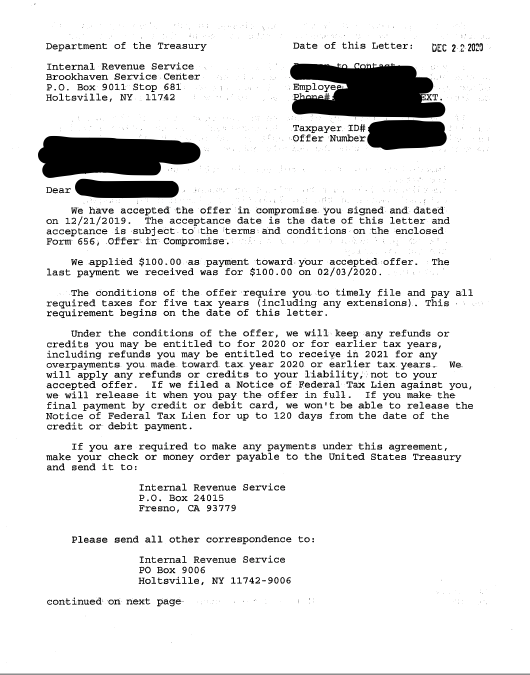

In the end, the IRS accepted Darrell’s offer in compromise and removed the lien. His original debt of $28,055.34 got reduced to $500 – saving over 98.2%!

See Darrell’s signed Offer in Compromise Below!

* Client’s name changed for privacy.