YUKON, OK. – Debra of Oklahoma started the spring season on a high note thanks to TaxRise.

Debra Barristan* is retired, lives with her son and his family, and the only thing that she owns is her vehicle. Debra had sporadic, unfilled taxes from 1998, 2016, and 2017.

In addition to her years of unfixed taxes, Debra also had a substantial history of medical bills and a significant amount of loans she needed to pay off.

Debra had unfixed taxes, medical bills, and loans that needed to be paid off.

Debra was in the process of paying off her medical bills and loans when she received a letter from the IRS informing her that they were going to issue a levy on her assets – or rather, her last asset.

Plus, the IRS had not forgotten about those few years of misfiled taxes. Debra’s total liability, as a result of unfiled and unpaid taxes, was $29,032.01, which was an amount she simply did not have the means to pay off.

For merely three filing mistakes, the IRS had flippantly decided to destroy Debra’s finances.

TaxRise’s Resolution Strategy

Once a comprehensive analysis of Debra’s case was complete, the professionals at TaxRise got to work on releasing the levy on her car.

Simultaneously, the TaxRise experts were also hard at work constructing an offer in compromise to present to the IRS and reduce Debra’s tax liability.

The IRS wanted to take away Debra’s last asset – her car. TaxRise wouldn’t let that happen.

Durning the tax relief process, there was a minor hiccup. Poor advice, given to Debra from another tax relief company, nearly disrupted the plans of TaxRise.

Nevertheless, our experts were able to resolve the issue quickly before the laziness (or ineptitude) of another organization ruined our client’s chance of tax relief.

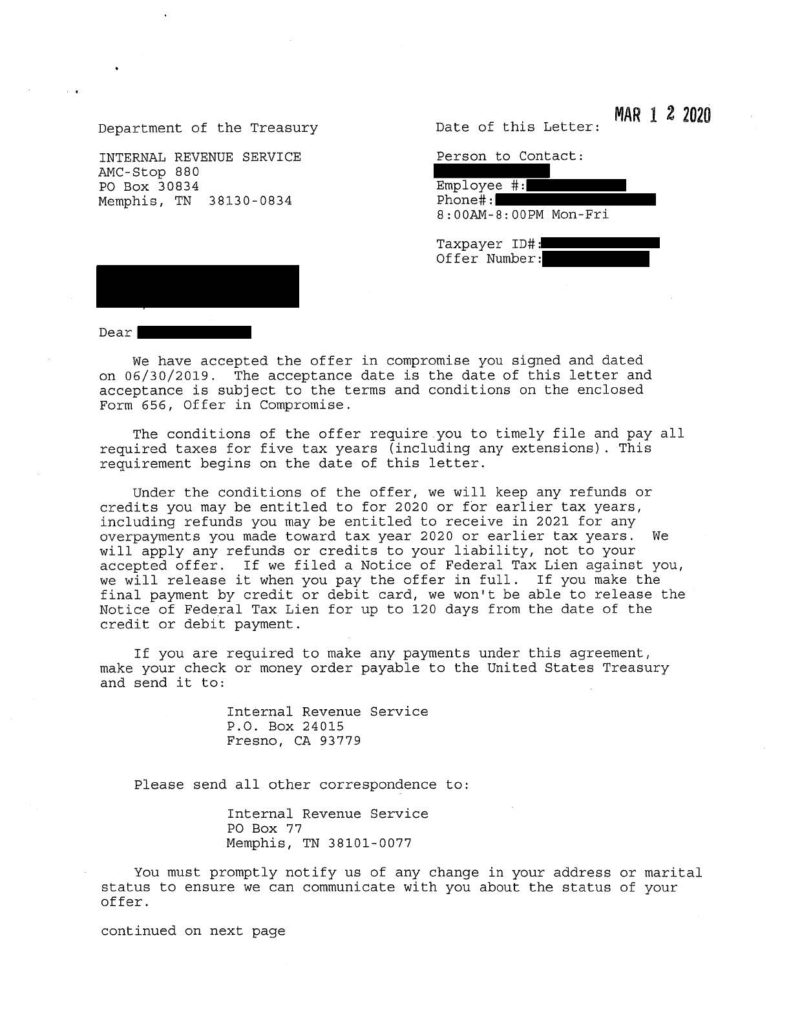

After some negotiations, both the client and the IRS accepted the offer in compromise, settling the $29,032.01 liability for $100 – a saving of 99.7%. The levy against Debra’s vehicle was removed as well.

The End Result

The TaxRise team prevented the IRS from taking Debra’s car and drastically reduced her $29,032.01 liability to $100.

See Debra’s accepted Offer in Compromise Below!

Be the next success story. Take our survey to see if you qualify for the Fresh Start program.

* Client’s name changed for privacy.