San Antonio, Texas – The tax professionals at TaxRise saved Eustace, a small business owner, from overwhelming debt and tax lien.

Eustace Benjamin* is a self-employed small business owner working in the real estate industry. Eustace’s debt began to accumulate the same way debt often does for many other hardworking Americans – a life-changing injury.

Eustace was in an intense accident that required him to have extensive back surgery. He had to get a cage and screws in his lower back, resulting in constant pain and routine sleepless nights. Moreover, his eyesight became poorer.

All of these factors made work much harder for him, especially since he was self-employed. However, he had bills that needed to be paid; so, he continued to press on.

Bills from a back injury and unpaid taxes led to the IRS coming after Eustace.

Eustace had tax liabilities dating back to 2003. Some had expired, but not all of them. When totaled up, his debt amounted to $27,440.32.

Finally, Eustace received a letter from the IRS. They were letting him know that they had placed a lien on his property and were going to collect if he did not pay off his debt or appear for a hearing in thirty days.

TaxRise’s Resolution Strategy

The TaxRise team knew that Eustace’s liability was a significant amount, one that would financially cripple him if he had to pay it in full. We acted immediately to reduce this liability and release him of his tax lien.

First, we sought to obtain the right to Power of Attorney for Eustace. This would prevent the IRS from sending any more letters or threatening to levy/garnish his wages.

Unfortunately, the IRS rejected Eustace’s right to POA. However, this did not deter our team who worked even harder to secure this right for our client.

Despite the stubbornness of the IRS, TaxRise pressed on to reduce our client’s tax debt.

At last, the experts at TaxRise were able to successfully obtain the right to POA for Eustace.

Simultaneously, the IRS rejected our first offer in compromise of $100 and proposed that Eustace repay his debt for a higher amount based on their calculations. The IRS also required that Eustace include 6 months of his bank statements as well as profit and losses for 2019.

Quickly and skillfully, the team at TaxRise worked with Eustace to organize the necessary information. We even were able to assist Eustace in claiming a certain number of miles he wanted to claim for driving clients.

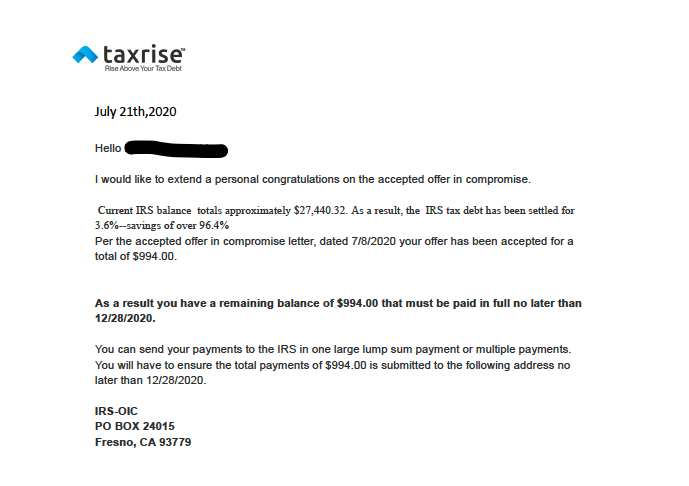

Eventually, after much negotiations, the IRS and Eustace agreed to a payment of $994. Thus, Eustace was released of his tax lien, and his debt was settled for 3.6% – saving over 96.4%.

The End Result

The TaxRise Team massively reduced Eustace’s tax debt and freed him of the lien on his property. His $27,440.32 debt was settled for $994 – a savings of 96.4%!

See Eustace’s signed Offer in Compromise Below!

Be the next success story. Take our survey to see if you qualify for the Fresh Start program.

* Client’s name changed for privacy.