Frank’s case was a product of simple miseducation about taxes; which spiraled into years of penalties and interest. He wasn’t making much money and received poor advice, resulting in him not filing a few times.

Even when you are unemployed, or have little income to report, it’s important to file and avoid unexpected penalties. If you made more money last year than you did this year, you should file this year so that the IRS doesn’t assume you’re still making more money. Most income is also taxable, including unemployment and Social Security benefits.

Little to no disposable income…

When Frank came to TaxRise in December of 2019, his tax debt was about $13,000. He didn’t have a 401(k), and he didn’t have many assets aside from a vehicle. Monthly expenses such as rent, car maintenance, medical, and groceries absorbed his budget rather quickly.

With little to no disposable income, Frank was in need of professional tax help.

TaxRise’s Resolution Strategy

After conducting our Discovery Investigation, where we evaluate the last 10 years of your tax history, Frank granted us Power of Attorney for his case. This protected him from levies, liens, and other collection activity. We collected necessary documents from Frank and prepared his taxes for the years that he didn’t file. Unfortunately, we didn’t anticipate what was to come in 2020.

The IRS closed and furloughed over 46,000 employees. This was a crucial time in Frank’s case and we didn’t want it to lose momentum. TaxRise had to work around the shutdown while so many clients were waiting anxiously to see results for their case. Eventually, we had to close our doors for over a month, adding more unprecedented delays for some cases.

Upon the return of the IRS and TaxRise, there was a lot of catching up to do. A lot of time passed as we waited for a response from the IRS and Frank was growing increasingly nervous about his case. Finally, the IRS responded to the returns and documents, allowing us to move for an offer.

A lot of Frank’s debt was wiped out from the tax returns. What remained was still too much for him to pay. At the time we made the offer, Frank owed $7,703.

The offer was to settle for and Offer in Compromise (OIC) for only 1.2% of the tax liability.

The case was finally resolved in Sept. 2020

The End Result

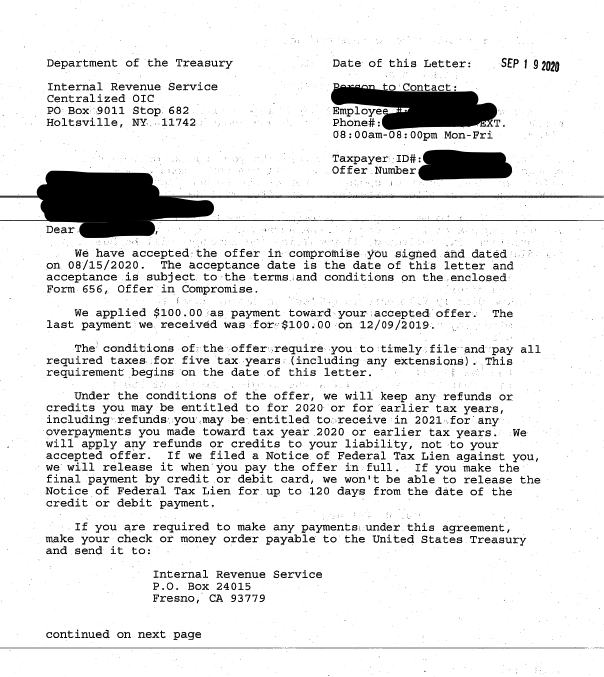

Frank’s offer was finally accepted in September of 2020. His tax debt was reduced from $7,703 to only $100 – a savings of 98.8%!

Frank expressed his gratitude and took a photo of his accepted offer letter, which you can view below!

* Client’s name changed for privacy.