Kittredge, Colorado – With the help of TaxRise, this Colorado woman was able to focus on repaying restitution without the burden of almost half a million dollars in tax debt.

In 2002, Jasmine* and her business partner were engaged in illegal activities. They diverted funds between several businesses and avoided tax payments. When they got caught, her partner pinned everything on her and obtained immunity.

When Jasmine got out, not only did she have to pay restitution, but she also owed almost half a million dollars to the IRS.

Jasmine owed the IRS almost half a million dollars.

Later, in 2012 Jasmine got divorced and entered into a payment plan with the IRS for $100 a month.

Living on garnished social security income with eighteen unfiled tax years, Jasmine sought professional help – which TaxRise provided.

TaxRise’s Resolution Strategy

When Jasmine became our client, she already paid the IRS $8,400 due to her payment plan. Still, those payments hadn’t even made a dent in her $457,664.48 total.

Jasmine was worried that because the IRS had access to her bank accounts, they could freely take her money.

We advised her that TaxRise would attempt to achieve an offer in compromise (OIC), and if that failed due to her past criminal proceedings, we would try to place her in currently non-collectable (CNC) status for her eighteen years of unfiled tax.

TaxRise protected Jasmine from collections, waived fees, and worked to get her tax debt closer to zero.

First, our tax experts succeeded in placing Jasmine in CNC status, protecting her from any IRS collections as long as she maintained compliance.

Then, TaxRise qualified Jasmine for a fee waiver because she lived of off social security income. Once all of her unfiled tax penalties got negated and, the various fees waived, her tax liability got reduced to $184,843.97.

Finally, our tax professionals engaged the IRS representatives in negotiations for an OIC.

The End Result

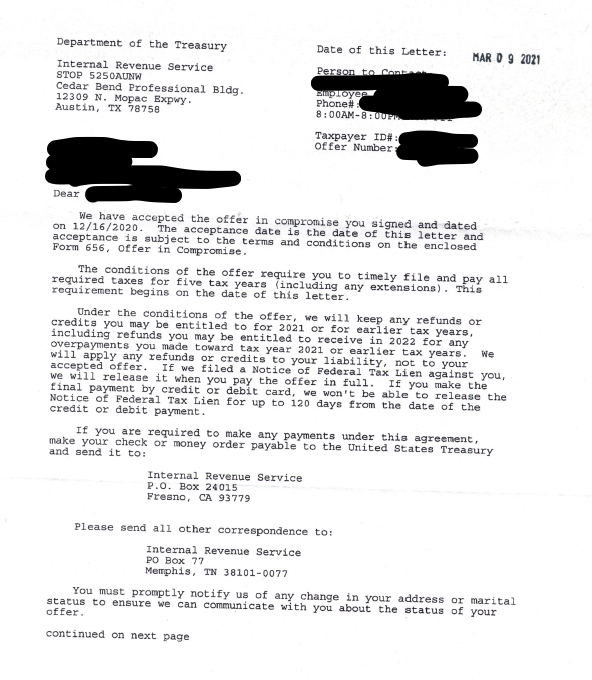

The IRS released Jasmine’s social security levy, terminated her payment plan, and accepted our OIC for $500. Her $184,843.97 tax debt settled for 0.2% – a savings of over 99.8%!

See Jasmine’s signed Offer in Compromise Below!

* Client’s name changed for privacy.