Richland, Mississippi –Amid a COVID-19 job loss, Joe*, a college football coach, finds help in TaxRise to overcome his lien and tax debt.

The pandemic was one of the most significant forces of disruption in recent history; millions of hardworking Americans lost their jobs.

Our client, Joe, lost his job as a college football coach. His age and health conditions put him at serious risk should he contract COVID-19. Overnight, every college campus in America became a strict no-go-zone for the foreseeable future.

Joe lost his job as a college football coach because of COVID-19.

Long before the pandemic, Joe and his family owed taxes for 2008, 2009, 2011, 2013, and 2015; 2018 remained unfiled. By 2019, Joe already paid $33,000 to the IRS through a wage garnishment – but his family still had over $16,000 in liabilities.

Although Joe managed to get off the installment agreement, the IRS put a lien on his assets. Still out of work and facing significant tax debt, Joe and his family turned to TaxRise for help.

TaxRise’s Resolution Strategy

While Joe wouldn’t be able to find a job anytime soon, he possessed significant disposable income. To an IRS examiner, this would be a legitimate means to disqualify him from relief -which is just what the IRS did by rejected our first offer in compromise (OIC).

We knew that success was slim unless we could prove that Joe experienced a drastic reduction in income or circumstances that prevented him from paying off the balance.

While the first OIC got rejected, TaxRise did not give up on our client.

Our experts recommended an installment agreement of $225 a month to protect Joe from future collections, but he couldn’t afford it.

After a reexamination of Joe’s situation, we noticed how serious a drain his medical bills were having on his savings. His heart disease, sleep apnea, surgeries, and medication, accumulated many costly medical bills.

Once again, The TaxRise team drafted an OIC. We obtained doctor statements and a statement from Joe, which explained his employment situation.

The End Result

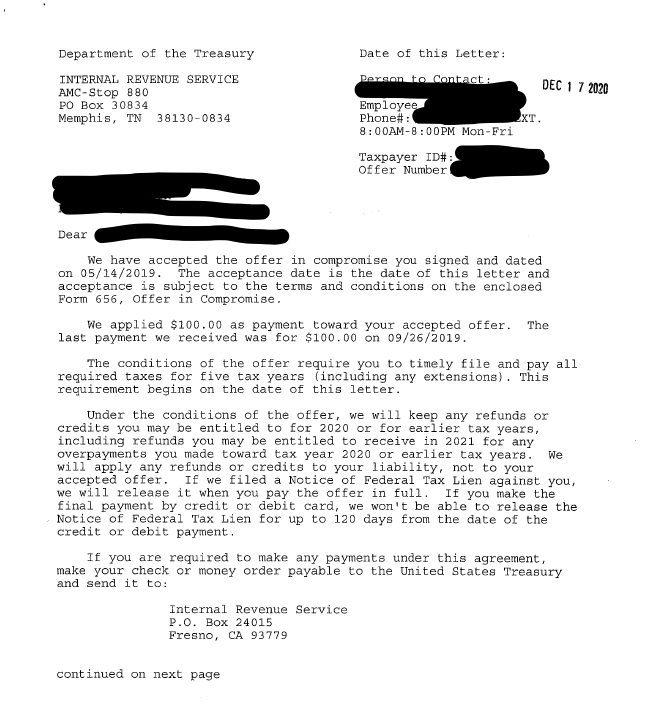

The IRS accepted Joe’s OIC, removing the lien and settling his $16,043.51 tax debt for $500. In total, Joe’s family saved over 96.9%!

See Joe’s signed Offer in Compromise Below!

* Client’s name changed for privacy.