Illinois – After a disastrous loss of property in 2009, *Kate managed to resolve over $800,000 tax debt through TaxRise.

Kate’s hardships began in 2006 but snowballed from there. She bought some property prior to 2006 with no down payments, just signatures; Kate couldn’t pay off the mortgages.

Her property went into foreclosure, and she couldn’t service the debt. In 2009, four of her properties closed, and then another two in 2010.

Kate lost all of her properties, including her place of primary residence.

Kate lost everything. When she attempted to pay back the old ones, she lost her primary residence. Eventually, the IRS got involved in 2015.

She had no choice but to enter into a payment plan with the IRS to pay $300 a month. After five years (and settling $18,000), Kate realized she was getting nowhere.

Finally, Kate reached out to TaxRise to resolve her seemingly impossible $806,312 tax debt.

TaxRise’s Resolution Strategy

After our initial consultation, we learned that Kate was retired and living on a fixed income. Furthermore, the IRS was charging daily interest on her tax debt, causing her outstanding liability to increase continuously.

The TaxRise team knew we had to get Kate out of her monthly payment plan and into a more favorable agreement; an offer in compromise would be far superior.

An offer in compromise (OIC) is an agreement between the taxpayer and the IRS to settle a tax bill for an agreed-upon amount. However, achieving an OIC is no easy feat.

Kate had been in a payment plan for 5 years with the IRS. TaxRise helped her get out of it and onto a better agreement.

TaxRise would need to prove to the IRS that – based on Kate’s limited income and her necessary living expenses – she could not re-pay $806,312.45 even if she made payments every month for the rest of her life.

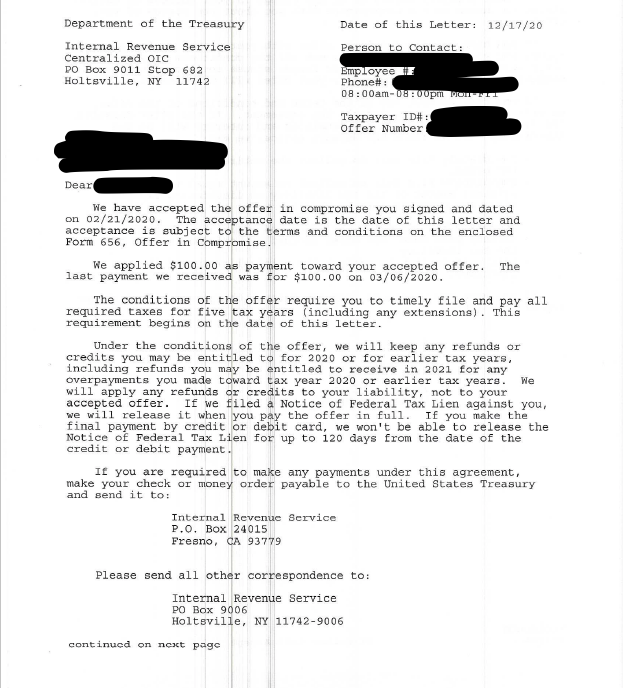

To build a winning case, we needed Kate to provide us with three months’ worth of recent pay stubs, three months’ worth of recent bank statements, a current statement for any life insurance premiums, her most recent health insurance statements, and a signed Federal Form “656” Offer in Compromise.

While all of this data may have seemed like an excessive amount of documentation, Kate’s information persuaded the IRS to agree to an OIC.

The End Result

Ultimately, Kate’s OIC was accepted for $500, and her $806,312 tax debt was settled for .0006% – a saving of over 99.9994%!

See Kate’s signed Offer in Compromise Below!

Be the next success story. Take our survey to see if you qualify for the Fresh Start program.

* Client’s name changed for privacy.