Kia* has a remarkable story. She was born in Kenya and raised by Jewish refugees. She is very well-educated, having studied at the University of Nairobi and Bristol University in the UK before moving to the US in 1982. Her stability thereafter was a roller coaster, beginning with a divorce that caused her to lose her first home, followed by her father’s death.

Struggling to find a job as a teacher (which she went back to school for in the States), Kia rented out rooms and took part time jobs to support herself and her daughter. Turmoil revisited her life in the form of a plane crash that her brother was piloting in Kenya. Kia maxed out six credit cards to cover his hospital expenses, putting herself in a great deal of debt.

Hoping to pay off her debts, she put her home on the market.

This was followed by the 2008 economic crash. Hoping to pay off her debts, she put her home on the market. She later purchased a home in Mexico to gain income from rent. Because her bank at the time was found to be a Ponzi scheme, this triggered her taxes to be audited. This was the start of her tax debt.

With one home in foreclosure, Kia worried about a lien being placed on her new property (which was purchased by her brother and partner).

TaxRise’s Resolution Strategy

At the time that she came to TaxRise, Kia’s tax debt accrued interest and the liability was approximately $39,000.

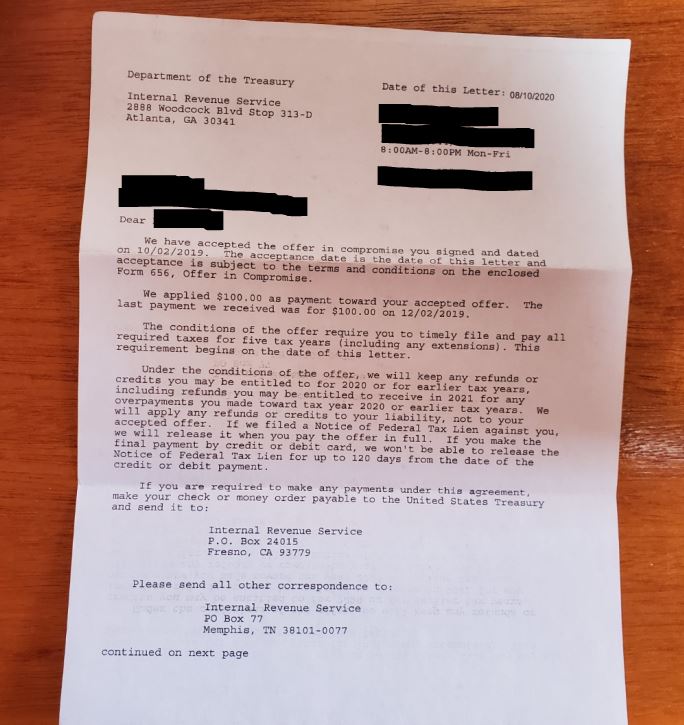

Kia is now 73 years old with a heart condition and still searching for work to cover her debt. Her team at TaxRise knew that the only option for her was an OIC, or offer in compromise.

With a detailed and heartfelt letter of hardship, Kia’s TaxRise attorney submitted an offer to settle for only 1.2% of the total liability. This was not an easy road, but any other option was simply unacceptable.

This is only a fraction of the epic life that Kia is living. Letters of hardship like hers are few, but necessary to win a case.

An offer to settle for only 1.2% of the total liability.

The End Result

Kia’s inspiring tale ends with a triumphant victory! Her TaxRise team was able to settle her $39,000 liability for only $500, wiping out over 99% of what she owed.

Be the next success story. Take our survey to see if you qualify for the Fresh Start program.

* Client’s name changed for privacy.