Greenbelt, Maryland – Despite cancer, a rough divorce, and years of unpaid taxes, TaxRise helped the schoolteacher resolve a massive tax debt.

Typically, the main reasons why taxpayers end up with uncontrollable debt are because of either job loss, divorce, or medical expenses. Liam* had two of these; divorce and medical expenses.

Liam works as a schoolteacher, which provided him and his family solid income. He did have a history of unpaid taxes and was on an installment agreement with the state for $300 a month.

Liam went through both a rough divorce and cancer treatment.

Liam was making efforts to rectify his debt, nevertheless, misfortune after misfortune would exasperate an already precarious situation.

He went through a rough divorce, which resulted in him having to pay child support and alimony. He was also diagnosed with cancer, which required costly radiation treatment. All of this took a heavy toll on Liam emotionally, financially, and physically.

Weary and laden with $52,874 in debt, the breaking point came when Liam revived a lien notification in the mail from the IRS.

TaxRise’s Resolution Strategy

One of the most effective ways to win an offer in compromise with the IRS is to prove that you, as a taxpayer, are experiencing hardship or will experience hardship as a result of paying back the amount demanded of you.

In Liam’s case, he had experienced two significant hardships. He would certainly suffer another should he be forced to pay his entire $52,874 liability.

While proving a hardship seems relatively straightforward, the IRS cannot merely take you at your word. They require lots of evidence before they accept an offer in compromise.

While there is a lot of documentation that goes into TaxRise’s process, it helps us negotiate with the IRS.

Our tax professionals got to work assembling and organizing all of the necessary information from Liam.

Doctors’ papers, bank statements, and proof of his children’s residency would all be instrumental in convincing the IRS of Liam’s inability to pay back the debt in full.

At last, after much negotiating with the IRS, TaxRise was able to release Lamidi of the lien on his property and win him an expectational offer in compromise.

The End Result

Liam accepted the offer in compromise and settled his $52,874 debt for $500, an extraordinary savings of over 99.1%!

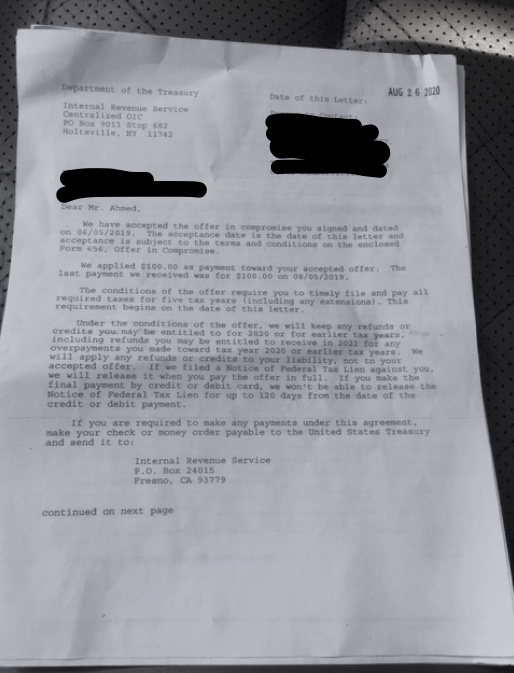

See Liam’s signed Offer in Compromise Below!

Be the next success story. Take our survey to see if you qualify for the Fresh Start program.