Wisconsin – Truck driver successfully reduces $24,511 debt after falling behind on taxes, thanks to the assistance of TaxRise.

Mahir* is a self-employed truck driver. He and his wife, Sidra*, always managed to stay on top of their bills and payments – until Mahir’s father started having heart problems.

Mahir’s father was quite elderly, and in 2017 his heart began to fail him. His heart conditions got so serious that he was unable to work or take care of himself. Mahir served as his father’s caretaker and covered all of his expenses.

Mahir split his income to care for his ill father, causing him to fall behind on his taxes.

While incredibly selfless, caring for his father was costly. Mahir had to split his income in half to cover all necessary expenses. Unfortunately, his father would pass away three years later in 2018.

During the years where he split his income, Mahir and Sidra fell behind on their bills and accumulated a tax debt of $24,511. With no feasible way of resolving his debt, Mahir turned to TaxRise.

TaxRise’s Resolution Strategy

The best debt relief program available to taxpayers is an offer in compromise. Ideally, TaxRise strives to get each of our clients an offer in compromise (OIC). In reality, it is quite a tedious and difficult process – not everyone can qualify.

When getting the IRS to approve an OIC, we must prove our client experienced hardship. In Mahir’s situation, there were sizable expenses that came along with his work as a truck driver.

Combined with the years he spent splitting his income, TaxRise could argue in favor of an OIC for Mahir.

The IRS can be difficult to negotiate with, but we had collected a sizable amount of evidence from Mahir to help with his case.

However, the IRS won’t just hand over an OIC; they need solid evidence. So, the professionals at TaxRise got to work compiling and organizing all vital information for Mahir’s case.

Just before we finished our work, Mahir informed us that the IRS had sent him a letter expressing their intent to put a levy on his assets. Thankfully, we had preemptively protected him with power of attorney.

The End Result

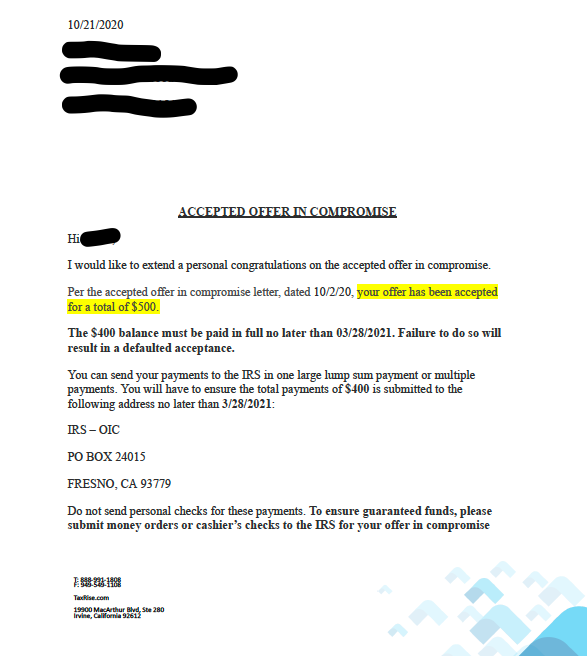

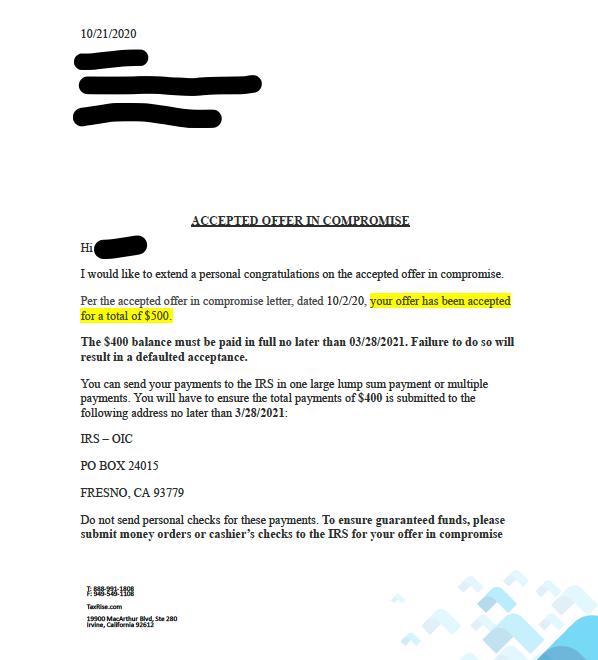

Mahir and Sidra’s OIC was accepted for $500. As a result, their collective IRS tax debt was settled for 4% – saving over 96%!

See Mahir and Sidra’s signed Offer in Compromise Below!

Be the next success story. Take our survey to see if you qualify for the Fresh Start program.

* Clients’ names changed for privacy.