Philadelphia, Pennsylvania – With the assistance of TaxRise, a retiree with zero income manages to resolve over $15,000 in tax debt.

Tax debt isn’t something that goes away over time; if anything, tax debt becomes worse over time. If you have back taxes, you must resolve it before retirement where, your fixed pool of income can be garnished without restraint by the IRS.

The scenario I just described happened to our client Martin*, who retired before resolving his many years of unfiled taxes.

Martin had ZERO income and many years of unfixed taxes.

Martin had unfiled taxes from 2013 to 2018.

Like many taxpayers, if Martin could not pay his taxes for a particular year, he’d put off filing until he had the money. Although such a strategy seems logical, it is regrettably illegal in the eyes of the IRS.

When Martin finally sought our help, he owed $15,586.00 and had zero income. Martin’s friends and family gave him money to get by, but he needed tax professionals to resolve his tax debt with the federal government.

TaxRise’s Resolution Strategy

On paper, Martin was an uncompliant taxpayer. As such, the IRS needed him to become compliant before they would allow for negotiations.

First, our tax experts helped Martin file all of his unfiled tax years. Martin wasn’t very tech-savvy, but we managed to assist him via phone.

Next, we leveraged a relief program called an offer in compromise or OIC to reduce Martin’s tax debt. Nevertheless, successfully obtaining an OIC can be very challenging.

While the first OIC got rejected, TaxRise did not give up on our client.

Our tax experts asked Martin to give us necessary documentation to prove to the IRS his inability to repay his tax debt. One such piece of information included bank statements showing that he no longer received SSI.

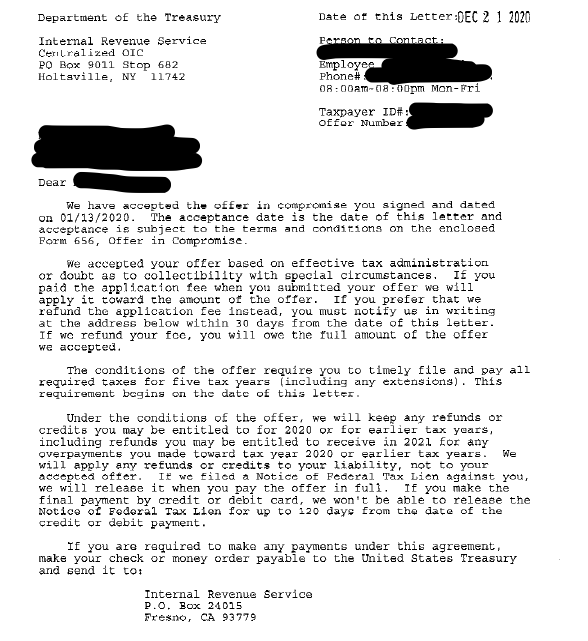

Initially, the IRS examiner rejected the OIC, stating that Martin still had a year of unfiled taxes. Despite the setback, we rallied and reentered negotiations with the IRS. This time, the examiner accepted the OIC.

The End Result

Martin’s tax debt began at $15,586, but after the accepted OIC, his tax debt shrank to a more manageable $500. As a result, his tax debt was settled for 3.2% – saving over 96.8%.

See Martin’s signed Offer in Compromise Below!

* Client’s name changed for privacy.