TaxRise reduces a retired couple’s tax liability by 99.7%

Burlington, NC | July 2022 — In a remarkable turn of events, a disabled Vietnam veteran and his wife overcome decades of financial hardship, ultimately finding relief through TaxRise’s services.

Mervin Erickson* faced seemingly insurmountable challenges: the loss of his home, displacement from his home country, and a six-figure IRS debt. Through TaxRise’s persistent efforts, his $142,021.64 tax bill was reduced to just $500.

A Series of Financial Blows

The Ericksons’ financial troubles reached a critical point in 2006 when they lost their home and all their assets. The subsequent recession only deepened their financial wounds, leading to an ever-mounting tax debt that seemed impossible to resolve.

With mounting financial pressures and an unsustainable cost of living, the Ericksons made the difficult decision to leave the United States. However, their tax debt followed them across borders, casting a long shadow over their attempts to rebuild their lives.

The IRS Strikes

By late 2018, when Mervin reached out to TaxRise, his tax debt had ballooned to over $100,000. The IRS, aware that their collection window was closing, took aggressive action. They seized the Ericksons’ bank accounts and garnished their social security payments, leaving them virtually nothing to live on.

TaxRise’s Resolution Strategy

Our team quickly recognized the urgency of the Ericksons’ situation. The first step was implementing a $100 monthly Installment Agreement to halt the IRS’s aggressive collection actions.

The case presented unique challenges. The Ericksons now lived abroad with limited internet access. Despite these obstacles, our team gave the Ericksons specialized care, ensuring they replied swiftly to each message.

When the IRS rejected our initial $100 settlement offer and countered with approximately $26,000, we made a bold decision. While many would have accepted an 80% reduction, we knew the Ericksons deserved better. With their trust in our judgment, we rejected the IRS’s counter-offer and submitted an appeal.

The End Result

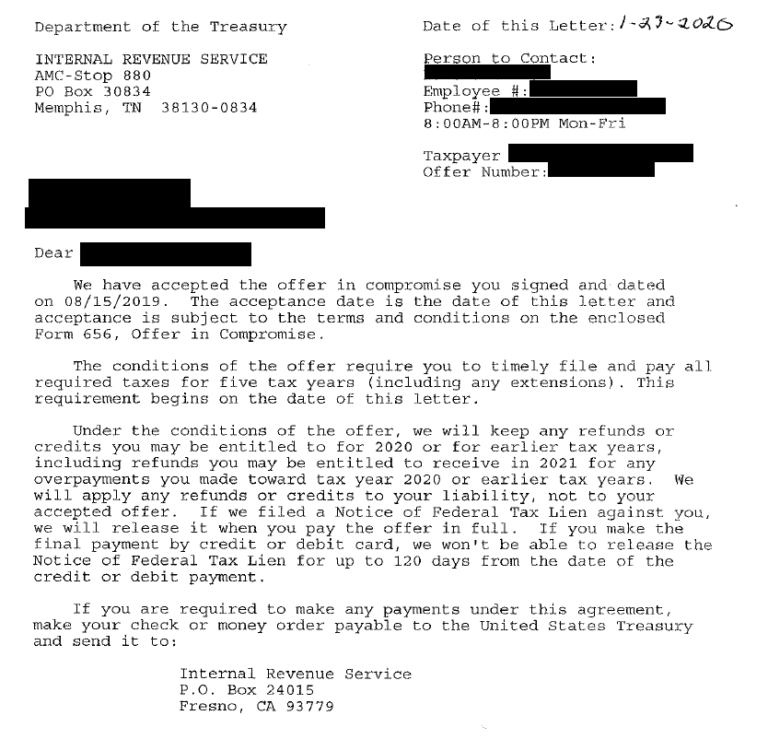

Our persistence paid off. On January 23, 2020, the IRS accepted our original offer of $500 – reducing the Ericksons’ federal tax debt from $142,021.64 to just $500, a remarkable 99.7% reduction.

With this crushing burden lifted, the Ericksons can finally look forward to a more stable financial future, a fitting outcome for a veteran who served his country with honor.

See the accepted offer from the IRS below!

Take our brief survey to discover if you may qualify for a similar resolution.

* Client’s name changed for privacy.