2020 has been a terribly difficult year for most of America. The global pandemic resulted in economic dismay with record-breaking unemployment rates. Many TaxRise clients this year were affected by furloughs and closed businesses. Rod* is a casino dealer that was dealt a bad hand due to the pandemic. With casinos closing and receiving less business, he had little money left to pay his bills.

Rod needed to catch a break and reduce his tax debt.

On top of this, Rod had accumulated back taxes and a dental bill that required monthly payments. Being a single father, whose son is out of work due to disability, he had to rely on his parents to help him stay afloat.

He came to TaxRise needing to catch a break and reduce his tax debt.

TaxRise’s Resolution Strategy

Rod’s TaxRise team began with a Tax Discovery, or a tax investigation. This was an extensive look into the last 10 years of Rod’s tax history; allowing his team to see what he really owed and how to help.

The investigation uncovered $21,000 owed in back taxes from 2013-2016. All of Rod’s tax returns needed to be as up to date as possible before proceeding with a resolution. Once his taxes were updated, he owed $16,142.

TaxRise Remained Persistent.

This case wasn’t an easy one. Rod’s TaxRise team had to re-submit his resolution proposal and there was a lot of back and forth with the IRS. TaxRise remained persistent and worked with him to get an offer that the IRS would accept.

The End Result

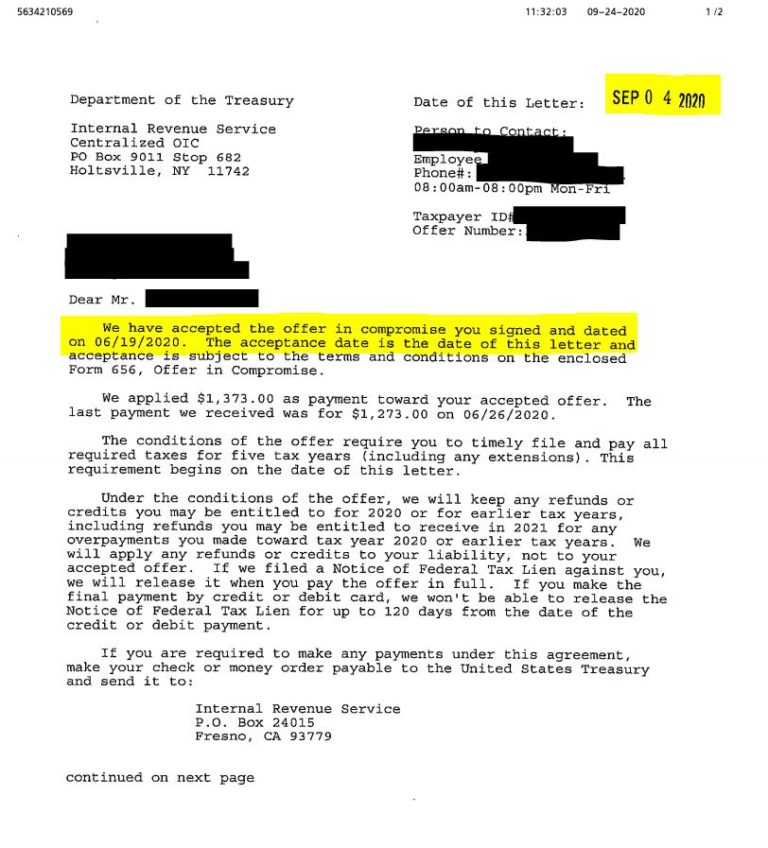

The final offer was submitted to the IRS to settle Rod’s debt for 39.4% of what he owed. Lady Luck was finally on Rod’s side, as this was the accepted OIC, saving Rod 60.6%! His liability of $16,142 was reduced to $6,363, with plenty of time to make payments within his budget.

You can view Rod’s accepted offer below!

* Client’s name changed for privacy.