New Jersey – A hopeful retiree resolves his tax debt, despite his history of unemployment and medical bills, thanks to the expertise of TaxRise.

Ronnie Springfield’s* debt history is similar to a majority of TaxRise’s clients (and delinquent taxpayers in general): unpaid medical bills and misfiling. Plus, he had a history of unemployment – seasons where he wasn’t able to find work at all.

The IRS is not forgiving. Misfiling your taxes is a fair enough cause to warrant a penalty in their eyes. In Ronnie’s case, he claimed too many dependents when filling out his most recent W2, primarily because he had worked most of his life as a 1099 filer or self-employed.

Ronnie’s debt was due to a combination of unpaid medical bills, misfiled taxes, and unemployment.

This mistake, compounded by his mounting unpaid medical bills and unstable income, resulted in an accumulation of a $10,080 liability. Ronnie wanted nothing more than to put his IRS worries behind him and retire debt-free.

TaxRise’s Resolution Strategy

After Ronnie explained his dilemma to TaxRise, we knew he could be in danger of incurring more penalties from the IRS. He had been delinquent for a decade, and he needed to get on good terms again with the IRS.

First, TaxRise implemented our power of attorney to temporarily protect Ronnie from collection efforts. Next, we asked Ronnie to help us assemble a large amount of evidence, including pay stubs, medical bills, and unemployment emails – anything we could use to negotiate with the IRS.

Although, Ronnie’s first offer in compromise was rejected, we kept working with IRS until we succeeded.

Unfortunately, the first offer in compromise (OIC) that we submitted got rejected by the IRS examiner. They said that they could not accept Ronnie’s OIC unless we were able to prove decreased income for the past three months, increased expenses, and medical diagnosis/prognosis.

At this time, Ronnie was frustrated with the IRS. He had just undergone heart surgery and was shocked to hear that the IRS needed further proof of his medical bills.

The TaxRise team regrouped and prepared even more evidence to present before the IRS. Despite the COVID-19 lockdown making communicate with the IRS difficult, we eventually were able to get through to them and secure a resolution.

The End Result

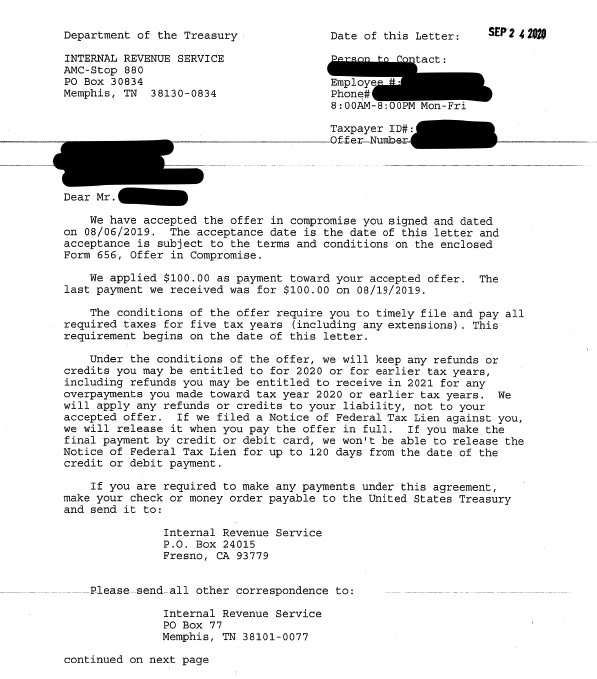

Ronnie’s offer in compromise was accepted, reducing his total debt of $10,080 to $500 – a saving of over 95.1%!

See Ronnie’s signed Offer in Compromise Below!

Be the next success story. Take our survey to see if you qualify for the Fresh Start program.

* Client’s name changed for privacy.