Bolivar, Missouri – TaxRise helps an unemployed and disabled taxpayer settle his $12,182 debt and free him from IRS collections.

Sean Wallace* suffered a severe brain injury because of an accident in 2010. Due to his injury, Sean developed various mental illnesses and issues.

The side effects of his mental health made it difficult for him to maintain employment, making it impossible for him to pay off his lingering debts.

Moreover, Sean wasn’t getting SSA and was still fighting to receive disability. He anticipated receiving about $1,340 a month in disability, but his court date was still pending, and nothing was set in stone.

Sean had no income. He wasn’t getting SSA and had yet to get disability.

Despite having no means of income, Sean had to keep going to therapy and other doctor visits.

Thankfully, the travel expenses for his appointments were covered by VA reimbursements. His other bills were paid for by his mother.

When Sean reached out to TaxRise, he had zero income and over $12,000 in unpaid tax debt, which had finally gained the attention of the IRS.

TaxRise’s Resolution Strategy

TaxRise’s mission is your freedom. Whenever we receive a case, our number one priority is to free our clients from the worries and burdens of their unpaid taxes.

We know that you have a life you want to live, and important problems you must address – tax debt should not be something you have to face on your own.

For Sean’s case, our goal was to resolve his tax debt as efficiently and professionally as possible so that he could focus all his energy on his mental health. To accomplish our goal, we needed to get Sean into an offer in compromise (OIC) with the IRS.

TaxRise put Sean on a temporary payment plan to stop the collection efforts of the IRS while we fought for a better deal.

To obtain an OIC, we had to prove that Sean had experienced hardship. However, the IRS is a complex bureaucracy; approving an OIC takes time.

While our tax experts negotiated with the IRS, we placed him in the absolute lowest and longest duration installment agreement available. The temporary fix bought Sean time, preventing his ‘wages’ from being garnished.

TaxRise’s professionals also used this extra time to build a strong case for the IRS examiner. In the end, our efforts paid off, and Sean’s debt was settled.

The End Result

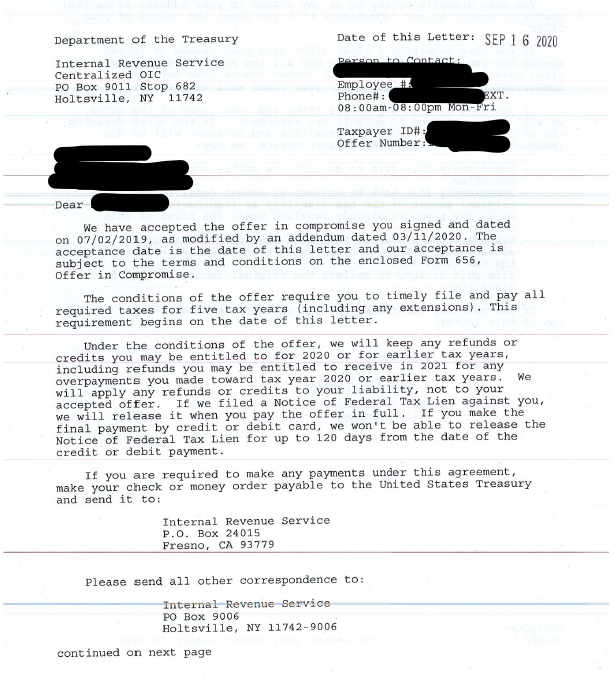

The TaxRise Team helped Sean obtain an offer in compromise, which reduced his $12,182 debt to $100 – a saving of over 99.2%!

See Sean’s signed Offer in Compromise Below!

Be the next success story. Take our survey to see if you qualify for the Fresh Start program.

* Client’s name changed for privacy.