TaxRise Reduces Tax Liability by 99.7%

April 23, 2020 – Kyle and Barbara Stevens* faced a complex tax situation after years of relying on disability benefits. Unable to file taxes for several years, their financial challenges grew when they began using retirement accounts for living expenses. Seeking help, they turned to a major tax company, which incorrectly advised them they could avoid taxes on retirement withdrawals. This flawed advice led to a $14,400 federal tax debt, which ballooned to nearly $20,000 with penalties and interest.

In 2018, the couple reached out to TaxRise for a solution.

TaxRise’s Resolution Strategy

TaxRise quickly analyzed Kyle and Barbara’s financial situation, including their disability income, retirement withdrawals, and ability to pay. We determined that an Offer in Compromise (OIC) was the best solution. This IRS program allows taxpayers to settle their debt for less than the full amount owed if paying in full would cause financial hardship.

Our team built a strong case, highlighting their limited income, essential living expenses, and good-faith efforts to resolve their tax issues.

The End Result

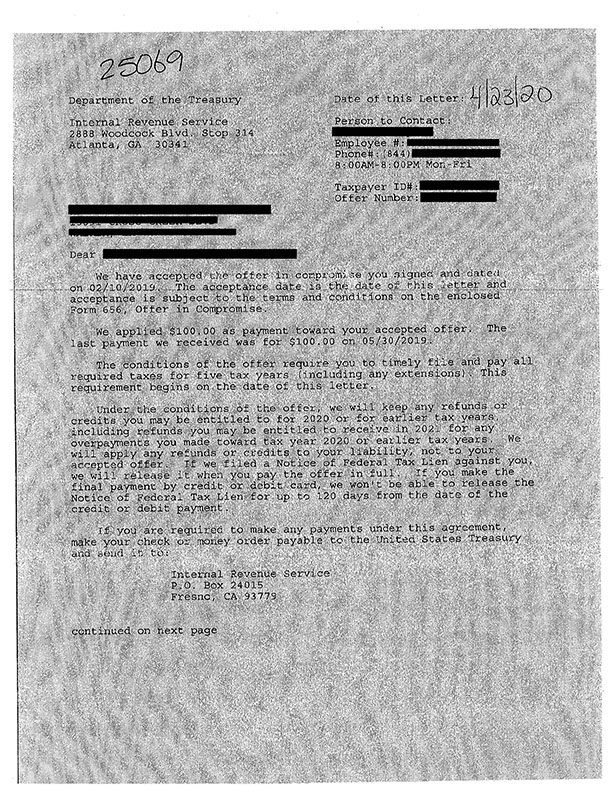

Through skilled negotiation, TaxRise secured an OIC with the IRS. The Stevens’ $20,000 tax debt was settled for just $500—a reduction of over 97%.

See Kyle and Barbara’s signed Offer in Compromise below!

Be the next success story! Take our survey to see if you may qualify for the Fresh Start Program.

*Client’s name changed for privacy.