NEWARK, NJ. — Trent W.* came to TaxRise in 2019 with an active Installment Agreement with the IRS that he had been paying into for the past eight months.

Trent is a well-respected realtor in the tri-state area, and compared to many of our clients – he definitely didn’t appear to be a strong candidate for any kind of financial-hardship related relief programs.

Trent owned a beautiful home with his wife and presented it very flashy. He told us that his image was part of his job, but in reality, he was “house-rich, cash-poor” and his monthly IRS payments were draining his funds.

Unfortunately, when Trent negotiated his Installment Agreement with the IRS on his own, he didn’t fully understand what the IRS was looking for when determining what they believed could be an affordable monthly payment.

The IRS did their math, and much to his horror told Trent that a $7,000 monthly payment was the best he could do. His other option was to pay off his six-figure tax bill off in full.

So, Trent took the offer and signed into an agreement with very harsh stipulations.

If Trent missed a payment, the IRS would immediately cancel out the agreement, conclude that Trent was actively avoiding his tax debt, and levy his bank account.

When Trent came to TaxRise, he knew that this was the month that he would be forced to default — and he was terrified.

TaxRise’s Resolution Strategy

Luckily, Trent was still technically compliant with the IRS when he came to TaxRise for help.

We didn’t have to waste anytime filing back taxes or otherwise tracking down old tax forms. Instead, we launched directly into strategizing his resolution.

Legally, we knew that Trent wouldn’t qualify for an Offer in Compromise. He made too much money and had too many assets; but we knew that we could get his monthly payment down significantly with proper negotiations.

Trent’s case is unique as it was almost 100% strategy.

The End Result

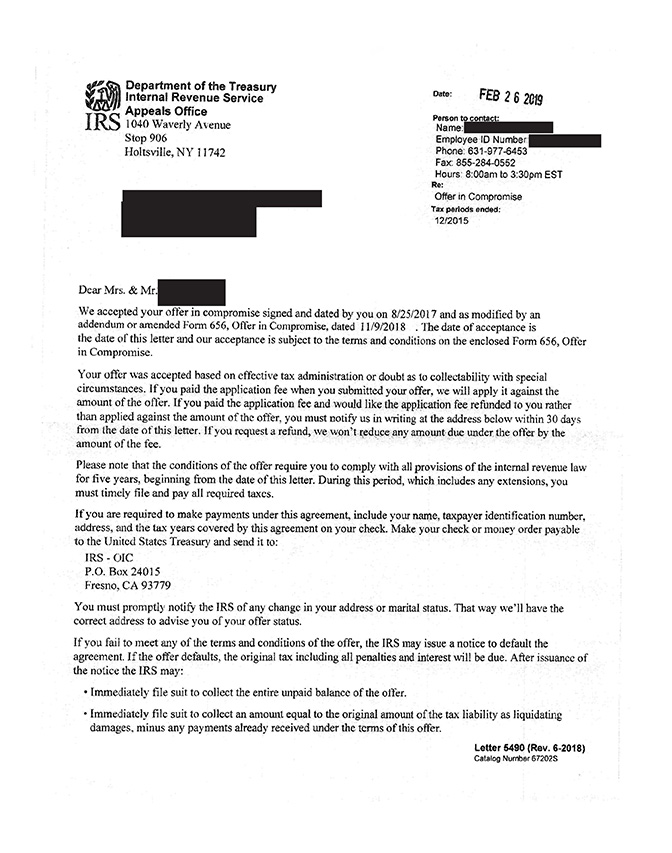

On February 26, 2019 we received the notice that Trent’s tax debt totaling $68,682.11 was settled for only $548 — a savings of over 99%.

See Trent’s accepted Offer in Compromise below!

* Client’s name changed for privacy.