Nebraska – A severely ill man battling lung cancer, chronic back pain, and other diseases, receives assistant from TaxRise.

Vernon Lander* had been enduring a long struggle against his illnesses. He became short of breath walking about his home, could not lift moderately heavy items without experiencing back pain, and was losing control of various bodily functions.

In summary, all of his medical issues rendered him permanently disabled and unable to obtain gainful employment. Unable to work or pay taxes resulted in Vernon accumulating $16,887 in debt.

Vernon’s cancer, chronic back pain, and other respiratory issues made it impossible for him to work.

Vernon could not afford to heat his home with natural gas, so he used his chainsaw to cut down trees for firewood. Eventually, Vernon was so low on funds he could no longer afford the gas for his chainsaw, nor could he afford his medication to alleviate his pain.

Perhaps the most tragic aspect of Vernon’s situation was that he had no money for a vital lung transplant. Without the transplant, his lung cancer would ultimately overcome him.

TaxRise’s Resolution Strategy

The first action the experts at TaxRise took was putting Vernon on the lowest installment agreement possible with the IRS. Establishing a payment arrangement with the IRS expresses to them that the taxpayer in question is actively trying to become current on their taxes. Thus, any IRS collection efforts are delayed.

Next, we drafted an offer in compromise (OIC) to try and reduce Vernon’s debt. Unfortunately, the OIC letter was rejected by the IRS. The examiner reasoned that there was some equity in Vernon’s home, his income was too high, and he needed to prove that he could not borrow against his home through loan denial letters.

The initially OIC was rejected, but TaxRise didn’t give up.

The rejection presented quite the task for the experts at TaxRise however, this task wasn’t beyond our ability.

After additional investigation and discussion with Vernon, we learned that his bank had mailed him a home loan denial letter in the past. Furthermore, Vernon was receiving income from AFLAC and SSA, but he was not getting paid correctly and was getting overcharged on his hospital bills.

The TaxRise team reconvened and drafted a new and improved OIC. This time, the IRS examiner faced so much overwhelming evidence they accepted the offer.

The End Result

Vernon’s offer was accepted for $500 – a saving of over 97.1% and a massive reduction to his original debt of $16,887!

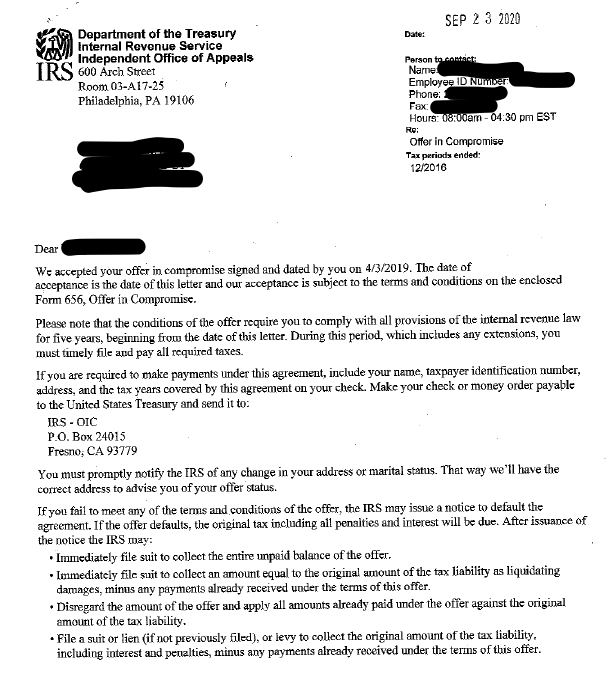

See Vernon’s signed Offer in Compromise Below!

Be the next success story. Take our survey to see if you qualify for the Fresh Start program.

*Client’s name changed for piracy