Phoenix, Arizona – The TaxRise team prevent Victor, a retired veteran, from losing his property.

Victor Gracie* is a retired veteran living in Phoenix Arizona. Victor owed money to both the State and the Federal government – two entities you don’t want to be in debt with. Due to his early retirement, he had no choice but to enter into an installment agreement with the IRS

An installment agreement is when a taxpayer agrees to pay back their debt to the IRS by making monthly payments. In Victor’s case, he had been paying $230 a month for 5 years.

Victor simply could not keep up with this pace; he had simultaneously to continue to make rent, pay for groceries, and make car payments.

Victor owed money to both the State and the Federal government

At last, when Victor got a letter from the IRS announcing their intent to levy his property, did he realize he needed help.

Victor came to TaxRise with $17,637 in unpaid back taxes and a levy courtesy of the IRS, who had finally grown impatient and wanted their money.

TaxRise’s Resolution Strategy

When TaxRise received Victor’s case, we knew immediately that we needed to free him of the levy. Moreover, we needed to get Victor off of his current installment agreement and onto a more favorable resolution.

Soon after we took Victor in as our client, the IRS sent him another letter. This time, it was an intent to terminate their installment agreement. Essentially, if we failed, there was no agreement in place to hold the IRS back from collecting as much as possible from Victor. Failure was not an option for us.

If TaxRise failed, there would be nothing to stop the IRS from collecting as much as possible from Victor

The experts at TaxRise got to work – our main goal was to secure an offer in compromise for Victor. To achieve an offer in compromise, we had to collect a large amount of information from Victor.

Most of our clients are hesitant to hand over so much personal information, nevertheless, without such data, we wouldn’t be able to successfully negotiate with the IRS.

Some information we needed from Victor included his most recent health insurance statements, details on his vehicle, three months’ worth of bank statements, and cashier’s checks.

The exchange of information was delayed and complicated by COVID-19, but that didn’t stop TaxRise from building a winning case for Victor.

The team at TaxRise did have to deal with a minor setback when we had to clear up a situation between Victor and his old girlfriend, who had added his name to her property so that she could refinance it.

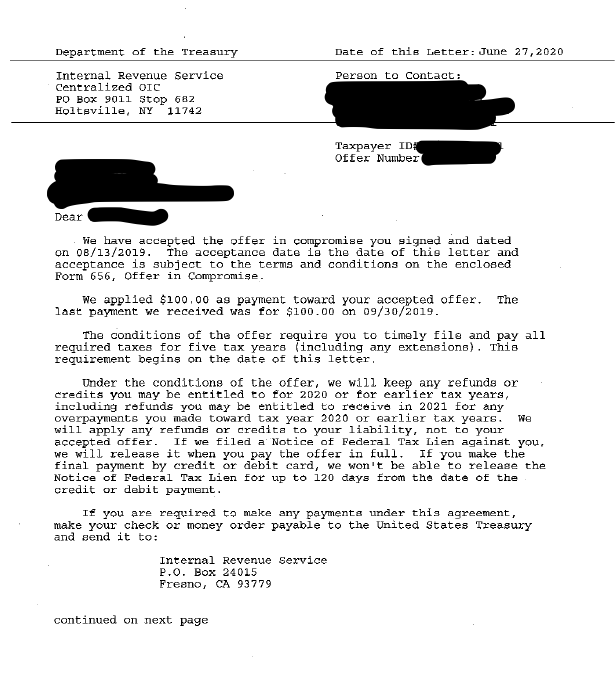

However, in the end, our tax professionals secured an offer in compromise for Victor, reducing his $17,637 liability to $500.

The End Result

Victor’s installment plan was replaced with an offer in compromise and the levy on his property was rescinded. Victor’s $17,637 debt was settled for $500 – a savings of 97.2%!

See Victor’s signed Offer in Compromise Below!

Be the next success story. Take our survey to see if you qualify for the Fresh Start program.

* Client’s name changed for privacy.