OAKLEY, CA. – Thanks to TaxRise, Winifred of California won’t have to worry about the IRS coming after her home any longer.

Winifred Calvary* is a police officer who served her community admirably until she was severely injured on the job. Winifred’s injuries would remain with her for the rest of her life, leaving her in a continuous state of pain.

This pain was so intense she could no longer serve her community as a police office – or perform most jobs for that matter.

Since it was extremely difficult for Winifred to work, and because her ex-husband was not helping her pay child support, she and her child were at risk of losing their home.

Due to a severe injury, Winifred could not work. Nor could she pay off the lien on her home.

Winifred had also been accumulating tax debt on her property for some years. The IRS had placed a lien on her home, but because of her crippled state, she had no financial means of getting rid of the lien.

Moreover, both the state and the IRS had her on payment plans of $100 and $600 a month respectively. In total, Winifred had accrued $135,000 worth in liabilities.

TaxRise’s Resolution Strategy

The experts at TaxRise conducted a comprehensive investigation of Winifred’s tax history. We collected every necessary piece of information to build the strongest case for her to quickly remove the lien on her home.

Even though the TaxRise team was able to prove that Winifred’s inability to work had led to her property debt, the IRS rejected the first offer in compromise.

However, we were not going to give up on our client; rallying, we created another OIC.

The TaxRise team was determined to save Winifred’s house despite our setback.

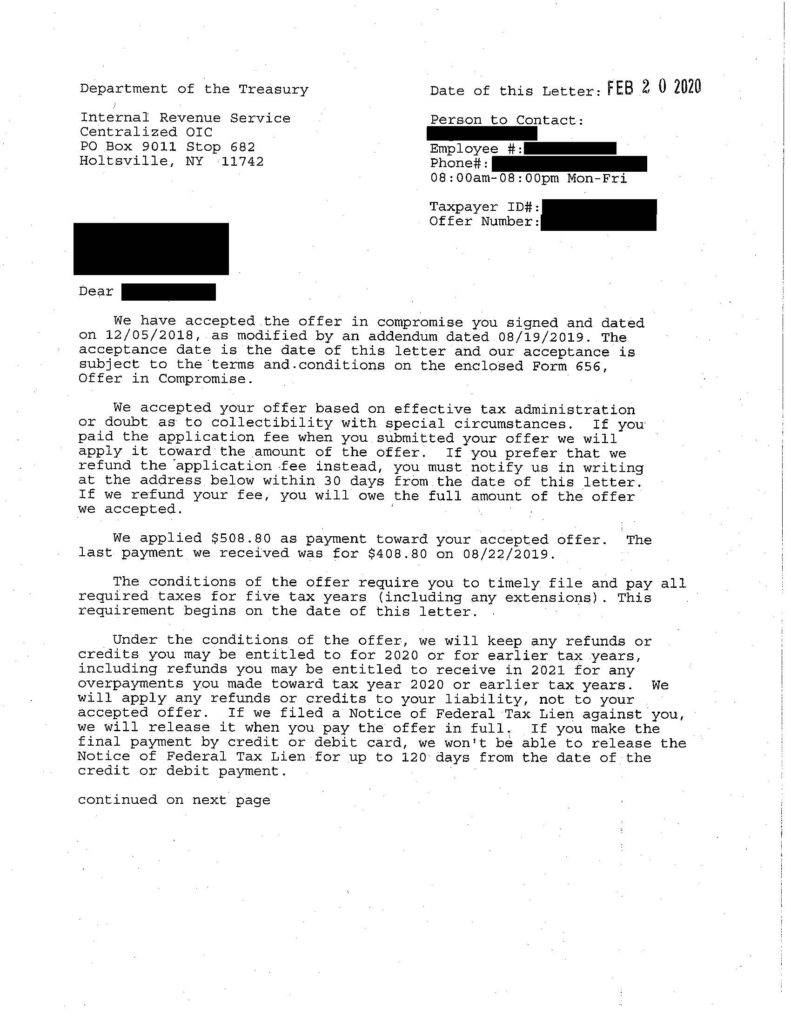

At last, the tax professionals of TaxRise were able to negotiate a resolution with the IRS, and they accepted our new OIC.

We were able to release Winifred of the lien on her property, saving her home for her and her child.

Furthermore, Winifred settled her $135,000 liability for $2,544 – a savings of 98.1%.

The End Result

Winifred, with the assistance of her allies at TaxRise, was able to remove the lien on her property and reduce her $135,000 liability to $2,544 – a savings of 98.1%.

See Winifred’s accepted Offer in Compromise Below!

Be the next success story. Take our survey to see if you qualify for the Fresh Start program.

* Client’s name changed for privacy.