An Offer in Compromise (OIC) is one of the primary programs offered under the IRS Fresh Start Program. When our clients discover that OIC is the best tax resolution program, more often than not, their first question is what the offer in compromise acceptance rate is.

Though we’ll get to that information in a minute, the Offer in Compromise program is more than its approval rate. Many different factors go into qualifying and being accepted for the OIC program. Building a strong OIC application and making a realistic offer amount will significantly increase your chance of IRS acceptance.

OIC Program Background

Unlike other Fresh Start Programs, the offer in compromise allows you to settle your tax debt once and for all. However, it’s also the program with the strictest qualifications. An OIC is an agreement with the IRS that allows the taxpayer to resolve their tax debt for less than the full amount owed.

The taxpayer’s reasonable collection potential (RCP) is determined, and based on this information, the IRS calculates how much the taxpayer can reasonably pay. To be eligible, you must meet several specific criteria.

Determining if You May Qualify

Though the OIC program has strict qualifications, fortunately, it’s very straightforward. Here’s what you must have:

- Prove your inability to pay (prove income, expenses, and asset equity)

- File all missing or incomplete tax returns

- Made all required estimated tax payments for the current year

- Your reasonable collection potential (RCP) must be less than the amount the taxpayer offered to settle for

Working with a tax resolution company will give you the best odds to qualify for an offer in compromise. Remember that when putting together all of your documents, the more evidence you give the IRS of your difficult financial situation and inability to pay, the more likely you’ll be accepted.

What Is The Offer In Compromise Acceptance Rate?

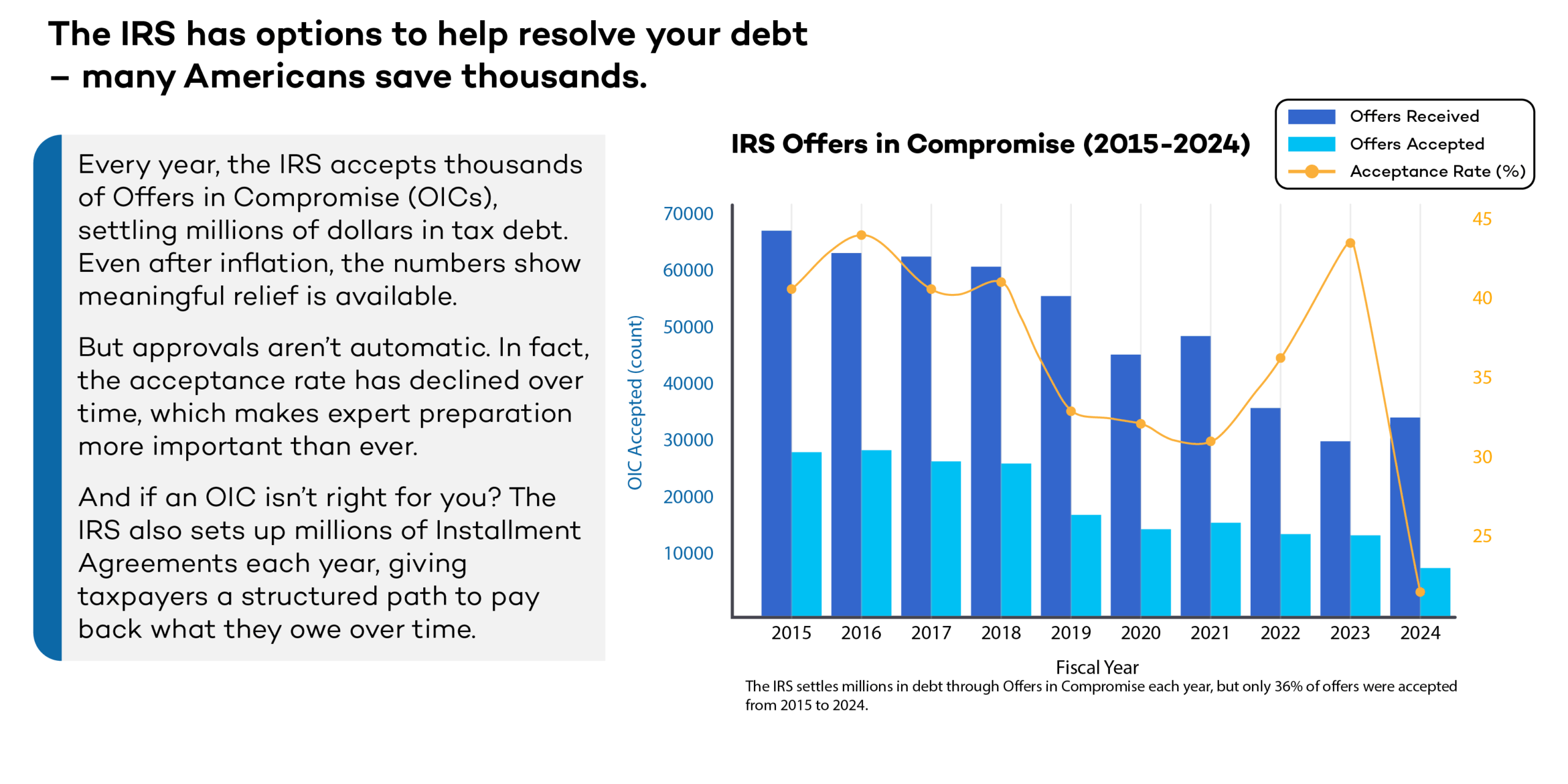

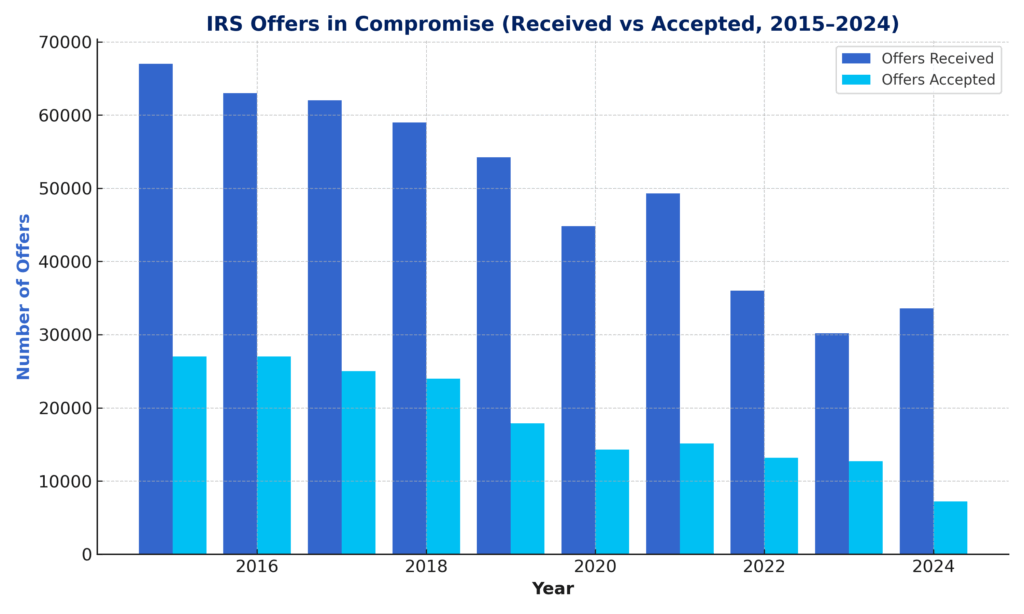

The IRS Offer in Compromise acceptance rate fluctuates each year, however, over the last ten years, it averages 36%. Between 2015 and 2024, taxpayers submitted a total of 499,095 Offers in Compromise, of which the IRS approved 183,407. That works out to a total acceptance rate of 36.7%, or just over one in three.

Over time, this number has shifted with economic conditions, IRS enforcement priorities, and the quality of the applications submitted. In tougher economic periods or when the IRS tightens standards, approvals tend to fall. This reinforces the fact that while the OIC program is challenging, a carefully built application can dramatically improve your odds of being approved.

For example, in 2015 and 2016, approval rates hovered around 40–43%, while in 2019 and 2020, they fell to about 31–33%. More recently, the rate climbed back up to 42.1% in 2023 before dropping sharply to 21.4% in 2024, despite an increase in offers submitted. These swings make it clear that the IRS’s approach to reviewing OICs can shift noticeably from one year to the next.

How Many Offers in Compromise Are Accepted?

The number of accepted Offers in Compromise fluctuates each year. However, looking at the big picture, between 2015 and 2024 the IRS received a total of 499,095 offers and accepted 183,407 of them. That adds up to just over one in three offers approved.

In 2023, the IRS received 30,163 Offers in Compromise and approved 12,711 of them, resulting in an acceptance rate of about 42.1%. That means nearly half of applicants were able to successfully settle their tax debt for less than the full amount owed. But the following year told a very different story. In 2024, the number of offers submitted actually increased to 33,591, yet approvals dropped dramatically, with only 7,199 accepted. This brought the acceptance rate down to just 21.4%, a steep decline from the year before. See the graph below for a complete picture of offer received and accepted over the last ten years.

Is it Worth Applying for an Offer in Compromise in 2025?

With the strict requirements and the relatively low IRS offer in compromise acceptance rate, many taxpayers wonder if it’s worth applying at all. The truth is that while the process is challenging, the potential reward is life-changing—resolving your tax debt for a fraction of what you owe. If you’re asking, “Does the IRS usually accept an offer in compromise?”, the answer is: not always. But when they do, the outcome can give you the fresh start you’ve been waiting for.

So, how many offers in compromise are accepted? Historically, about one in three. That number might sound discouraging, but it’s important to remember that acceptance rates rise significantly when taxpayers submit well-prepared applications. The biggest difference-maker is having professional guidance to make sure your offer is realistic, your paperwork is complete, and your case is as strong as possible.

In 2025, the OIC program is still one of the most powerful tools available through the IRS Fresh Start Program. If your financial situation qualifies, applying is absolutely worth it. An experienced tax relief team can help tip the scales in your favor—so instead of being part of the rejection statistic, you join the group of taxpayers who finally resolved their debt once and for all.

Why Work With TaxRise?

If only one in three OIC resolutions are approved, why take the chance of your offer being rejected by the IRS?

You should also consider the big picture—qualifying for an OIC is about more than just the acceptance rate. Many would consider the application process to be a daunting task. From filing unfiled taxes to a holistic financial review, and dozens of pages of IRS form, even a seasoned tax professional would need to dedicate several days or even weeks to complete the process.

After all, TaxRise specializes in helping OIC-qualified taxpayers secure IRS approval. That’s why we’re the fastest growing tax relief company in the nation!

The Takeaway

Check out TaxRise’s free tax consultation to find out where you stand financially. From this quick call, you’ll be able to determine if you qualify for our services and which tax relief program will work the best for your unique situation. TaxRise has helped thousands of taxpayers just like you resolve their tax issues and overcome their tax liability. Now it’s your turn.

0 Comments