San Francisco, California – A single mom taking care of her two sons, her mother, and her grandmother manages to overcome ruthless creditors and her landlord with TaxRise.

Louise* is a single mom living in San Francisco with her two sons and her mother. Across the ocean, in the Philippines, she also provides monetary support for her 93-year-old grandmother.

Our client Louise did not pay her taxes for 2014 to 2018. Primarily, her delinquency was due to a combination of several hardships.

Louise owed over $40,000 in tax debt before TaxRise helped her!

In 2018, her Aunt – who was once her guardian – passed away. That next year, her landlord unexpectedly sold her family’s property of four years. Louise had no choice but to take out a loan to cover the moving expenses.

But that’s not all: her entire family had impacted wisdom teeth for which every member needed dental surgery – costing $12,000.

Of course, Louise’s tale wouldn’t be complete if we left out that in 2016 a creditor sold her account to a third-party collection agency who leveraged a wage garnishment totaling $10,000 over several years.

TaxRise’s Resolution Strategy

Right away, the TaxRise tax professionals built a strategy to settle Louise’s $44,104.57 tax debt for an affordable amount.

First, we revealed to the IRS that Louise did not receive child support and that her 401K money paid for necessary living expenses. TaxRise demonstrated Louise’s financial dilemma further through proof that she was in an installment agreement for $150 a month with the State of Californian.

The TaxRise team worked hard to settle Louise’s tax debt with the IRS.

Then, we attempted to prove that Louise could not borrow again; doing so would ensure that the IRS Examiner would provide additional time and decrease the offer in compromise to $591.

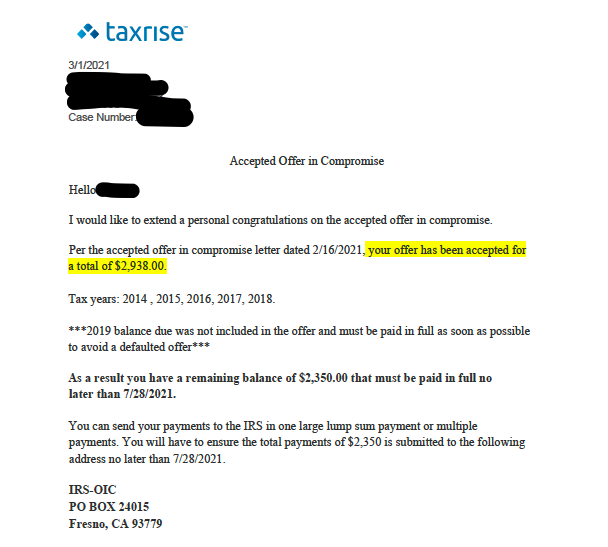

Unfortunately, Louise could not prove this, and our original offer for $500 – was rejected. Nevertheless, TaxRise succeeded in reducing Louise’s tax debt to $2,938 through another offer in compromise.

The End Result

The IRS agreed to the offer in compromise and reduced Louise’s $44,104.57 tax debt to $2,938! As a result, she settled for 6.7% – saving over 93.3%.

See Louise’s signed Offer in Compromise Below!

* Client’s name changed for privacy.