If you owe back taxes, you may be wondering how owing the IRS will affect your credit score. A credit score is an important factor in your financial health, so this is a beneficial concept to understand.

In this article, we’ll cover what a credit score is, tax liens, and how to get rid of tax debt.

What Is A Credit Score?

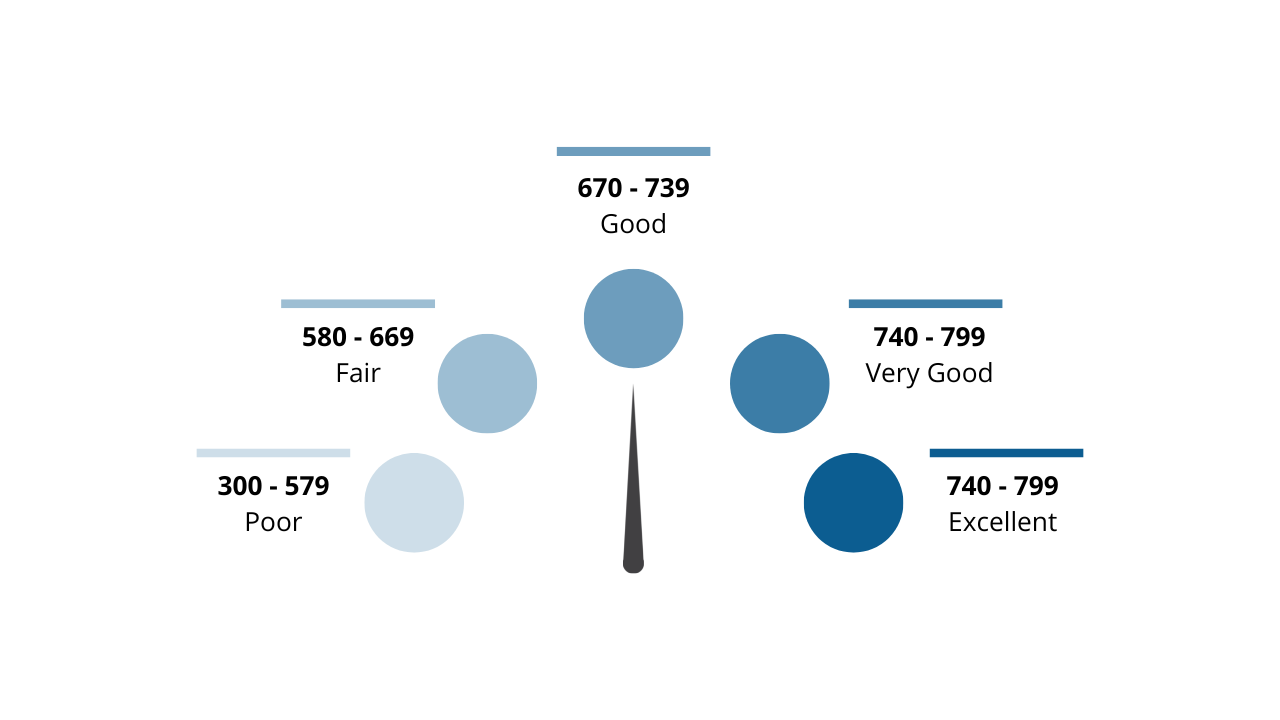

We’ve all heard of and most likely have credit scores. A credit score is a numerical score that helps lenders determine your level of risk for repaying a loan. The range is generally between 300 – 850, and the higher the number, the more likely you’re deemed to be able to repay a loan on time.

Many factors go into determining your credit score, one of which is debt. The majority of credit cards have limits, and your debt utilization percentage matters a lot. The general rule of thumb is to keep your rate at 30%.

For instance, let’s say your maximum credit card limit is $10,000. Using this recommendation, you should never have a balance greater than $3,000. Please note that you can still pay off your card in full each month.

A common misconception is that you must go into debt in order to build your credit score. This is not true at all!

The entire purpose of a credit card is to quantify to lenders how likely you are to pay off your debt.

Does Owing The IRS Affect My Credit Score?

Since a credit score is a representation of how likely you are to pay your expenses on time, won’t owing money to the IRS affect your credit score?

Though it may seem like it, this isn’t necessarily true.

The IRS doesn’t report directly to the credit bureaus. In fact, there are laws prohibiting the IRS from disclosing your tax return information to third parties. However, there is a catch.

Once the IRS files a Notice of Federal Tax Lien against you, your debt becomes public record. Essentially, this alerts creditors that the IRS has a legal claim to your assets.

If this sounds scary, then you’re right — it is. Having a tax lien filed against you can significantly impact your life, potentially even preventing you from qualifying for a mortgage or car loan.

Fortunately, there is a light at the end of the tunnel. TaxRise offers a free tax consultation where we analyze your unique financial situation and determine which tax relief program best suits your situation.

We understand just how stressful it is to have the IRS come after you, so we can negotiate on your behalf to the IRS for the best possible resolution. Book your call and receive the professional resources you need today.

Will My Tax Debt Show Up On My Credit Report?

Fortunately for taxpayers, the credit bureaus changed their reporting policies in 2018. Before then, tax liens were allowed to be reported on your credit report.

Now, if you have a tax lien against you, then your credit report won’t show the tax lien. However, remember that your tax lien is still public and anyone, especially lenders, can still view it.

How To Get Rid Of A Tax Lien?

The best way to get rid of a tax lien is to enroll in the Fresh Start Program. When arrangements are made, your tax lien could vanish (if you owe less than $25,000).

Establishing a payment plan (or other course of action) is your best bet to get rid of a tax lien.

How Does Being Enrolled In The Fresh Start Program Affect Your Credit?

The Fresh Start Program is a collection of programs that are designed to help you repay back taxes. Here’s a comprehensive article on the Fresh Start Program and how to get started. (If you’re not interested in determining which program is best for you and just want a professional to tell you, book our free tax consultation).

As mentioned before, the IRS doesn’t report to the credit bureaus. So, if you’re enrolled in a Fresh Start Program, it won’t show up on your credit report.

The Takeaway

TaxRise has helped thousands of American taxpayers just like you resolve their tax issues and erase their tax liability. Check out our free tax consultation. From this quick call, you’ll be able to determine if you qualify for our services and which tax relief program will work best for your unique situation.

We help advocate on your behalf to the IRS. We save you stress, time, and money — while providing you with the most optimal resolution.

0 Comments