Cryptocurrency Taxes:

A Complete Tax Guide For All Cryptocurrencies For 2023

Cryptocurrency is starting to transform how people send money to others. With this unique method of payment booming over the last several years, the American government has become more strict with its tax laws.

Tax laws in the U.S. are infamous for their complexity, and cryptocurrency rules are no different.

What Is Cryptocurrency?

Cryptocurrencies are a type of digital currency that is controlled and tracked by a decentralized system. In other words, instead of storing money through banks or other financial institutions, cryptocurrencies give more flexibility and control to the consumer.

There are multiple crypto currencies on the market. The two with the largest market share are Bitcoin (BTC) and Ethereum (ETH).

Do You Pay Taxes On Cryptocurrency?

Yes, you must pay taxes on cryptocurrencies. In America, cryptocurrencies are treated like assets.

When Is Cryptocurrency Taxed?

In general, the IRS treats capital gains on crypto as they would capital gains in other assets, such as real estate or stocks.

The increasing regulation of cryptocurrency was introduced in the American Infrastructure Bill of 2021.

On your tax return (Form 1040) you’ll be asked if you received, sold, sent, or exchanged any virtual currency.

However, cryptocurrencies are approached slightly differently than stocks. At the end of the tax year, your brokerage gives you a Form 1099, a brokerage statement. This is where you fill out your gains and losses throughout the year.

However, since cryptocurrencies are decentralized, only you know your cryptocurrency information. (Unsurprisingly, the IRS doesn’t receive much helpful information from cryptocurrency exchanges.) So, you must provide it yourself. Though you may not receive a Form 1099 for the year, you still have a tax liability.

Taxable Events

Here are some transactions you can do with crypto that will cause your cryptocurrency to be taxed:

If you earn over $600 in any exchange, you receive a Form 1099. If you earn less than this (even just $1), then you still owe taxes! Please note that this is for capitalized gains.

If you gift or inherit cryptocurrencies, this will be taxed just like any other asset and be subject to the gift tax.

Also, unlike regular currencies, if you pay for a good or service with cryptocurrency, you owe taxes on the difference between the price you bought the crypto at and its value at the time you spent it.

And finally, if you mine cryptocurrency, it counts as income.

Non-Taxable Events

You don’t owe taxes on cryptocurrency if you:

- Buy crypto with fiat currency (government-issued currency)

- Donate to tax-exempt organizations

- Transfer cryptocurrency between wallets

How Do Cryptocurrency Taxes Work?

Cryptocurrency taxes follow the same rules as other assets. Crypto is subject to capital gains.

If you held crypto long-term (over one year), you’ll be subject to a lower capital gains tax rate than short-year crypto holdings (under one year). If you have a retirement account, such as a Roth IRA, you won’t need to pay capital gains taxes unless you withdraw money from your account.

Capital gains taxes are for non-retirement accounts. We included a tax rate table for capital gains below.

Can The IRS Track Your Cryptocurrency Activity?

Despite cryptocurrency being decentralized, you may think that the IRS won’t be able to track your cryptocurrency activity. And, to be fair, this holds some truth.

However, recently the IRS has forced crypto exchanges to report to them. When some exchanges refuse to report, they receive subpoenas to comply.

It’s (always) in your best interest to report your cryptocurrency income and transactions honestly and openly, as it’s guaranteed that the IRS will be able to access more information in the future.

How To Buy And Sell Cryptocurrencies (And Keep Tax Records For Them)?

Buying, selling, and keeping tax records for cryptocurrencies doesn’t have to be difficult. Here are a few easy ways to get started.

1. Keep All Records Of Transactions

As mentioned previously, the IRS is becoming more strict with cryptocurrency regulations. Whenever you do anything involving crypto, keep a receipt of the transaction just in case.

2. Determine Your Tax Rate

Here are the tax tables for crypto taxes. Generally, cryptocurrency capital gains are taxed at the same rate as any other capital gain.

There are two types of capital gains: short-term and long-term. These are important to differentiate, as they have different tax rates.

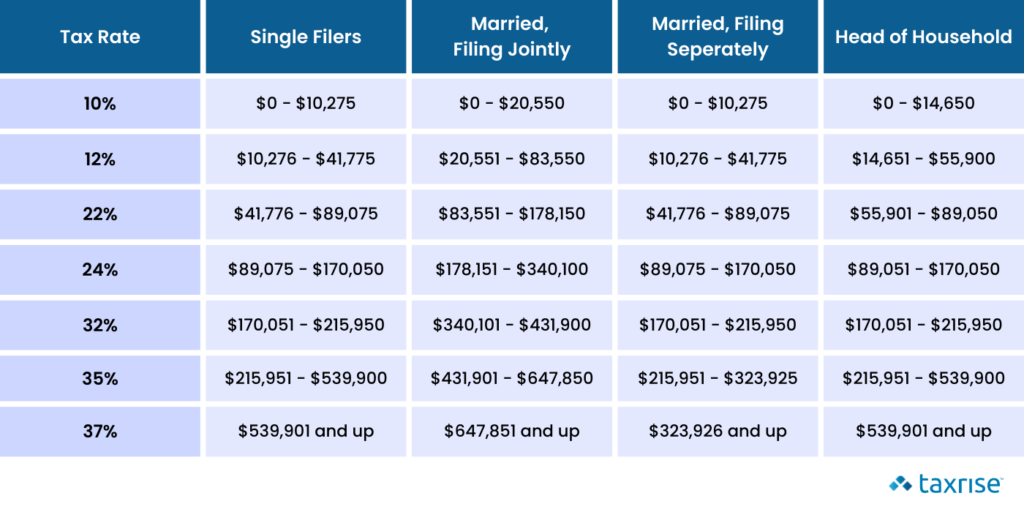

Short Term Capital Gains Tax Rate Table

For short-term gains, you pay more taxes if you sell the crypto before a year. These are the same rates as your ordinary earned income.

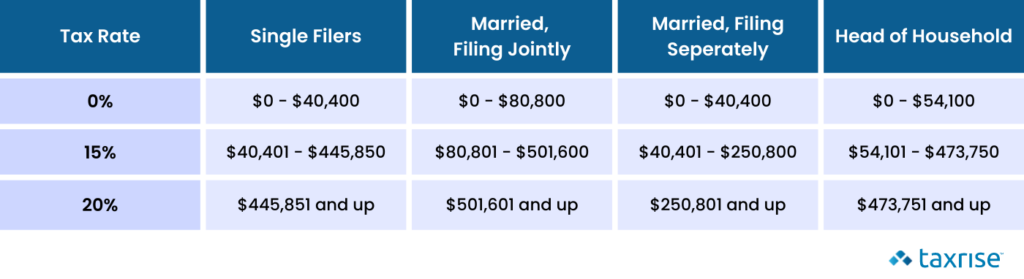

Long-Term Capital Gains Tax Rate Table

If you sell crypto after a year of holding, your tax rates are much more favorable.

How To Minimize Cryptocurrency Taxes?

Here are a few suggestions on how to legally minimize your cryptocurrency taxes.

1. Trade In A Retirement Account (Roth IRA)

In a Roth IRA, which is a tax-exempt retirement account, the only time you pay taxes is when they’re taken out of your gross income.

This is a huge advantage! Compound interest is on your side.

If you wish to dabble in crypto, a Roth IRA is the perfect place to do it.

2. Focus On Long-Term Gains

As seen in the tables above, long-term capital gains give you the best overall tax rates.

While you can focus on the short-term gains instead, you will have to make more profit on each sale.

The Takeaway

In reality, cryptocurrency taxes aren’t as scary as they sound. However, many shifting IRS regulations have put many Americans into owing back taxes to the IRS.

If you find yourself in this situation, TaxRise can help! Check out our free tax consultation to learn more about what we can do for you!